| 4834-9142-1879 v.10 CREDIT AGREEMENT by and among DIRECT DIGITAL HOLDINGS, LLC COLOSSUS MEDIA, LLC HUDDLED MASSES LLC ORANGE142, LLC UNIVERSAL STANDARDS FOR DIGITAL MARKETING, LLC and EAST WEST BANK Dated as of September 30, 2020 |

| 4834-9142-1879 v.10 i TABLE OF CONTENTS Page ARTICLE I. DEFINITIONS........................................................................................................................ 1 1.01 Definitions ......................................................................................................................... 1 1.02 Accounting Matters ....................................................................................................... 17 1.03 Other Definitional Provisions ....................................................................................... 17 ARTICLE II. ADVANCES ....................................................................................................................... 18 2.01 Advances. ........................................................................................................................ 18 2.02 General Provisions Regarding Interest, Etc. ............................................................... 19 2.03 Unused Facility Fee ........................................................................................................ 20 2.04 Use of Proceeds ............................................................................................................... 20 2.05 Late Charges .................................................................................................................. 20 2.06 Funding Loss .................................................................................................................. 20 ARTICLE III. PAYMENTS ...................................................................................................................... 20 3.01 Method of Payment ........................................................................................................ 20 3.02 Prepayments. .................................................................................................................. 21 ARTICLE IV. SECURITY ........................................................................................................................ 21 4.01 Collateral ........................................................................................................................ 21 4.02 Setoff ............................................................................................................................... 21 ARTICLE V. CONDITIONS PRECEDENT ............................................................................................ 22 5.01 Initial Extension of Credit ............................................................................................. 22 5.02 All Extensions of Credit ................................................................................................ 23 ARTICLE VI. REPRESENTATIONS AND WARRANTIES .................................................................. 24 6.01 Corporate Existence ...................................................................................................... 24 6.02 Financial Statements, Etc .............................................................................................. 24 6.03 Action; No Breach .......................................................................................................... 25 6.04 Operation of Business .................................................................................................... 25 6.05 Litigation and Judgments ............................................................................................. 25 6.06 Rights in Properties; Liens ............................................................................................ 25 6.07 Enforceability ................................................................................................................. 25 6.08 Approvals ........................................................................................................................ 25 6.09 Taxes ............................................................................................................................... 25 6.10 Use of Proceeds; Margin Securities .............................................................................. 26 6.11 ERISA ............................................................................................................................. 26 6.12 Disclosure ........................................................................................................................ 26 6.13 Subsidiaries, Ventures, Etc ........................................................................................... 26 6.14 Agreements ..................................................................................................................... 26 6.15 Compliance with Laws .................................................................................................. 27 6.16 Regulated Entities .......................................................................................................... 27 6.17 Environmental Matters. ................................................................................................ 27 6.18 Intellectual Property ...................................................................................................... 28 6.19 Foreign Assets Control Regulations and Anti-Money Laundering ........................... 28 6.20 Patriot Act ...................................................................................................................... 28 6.21 Solvency .......................................................................................................................... 28 6.22 Anti-Corruption Laws ................................................................................................... 28 6.23 Beneficial Ownership Regulation ................................................................................. 29 --- |

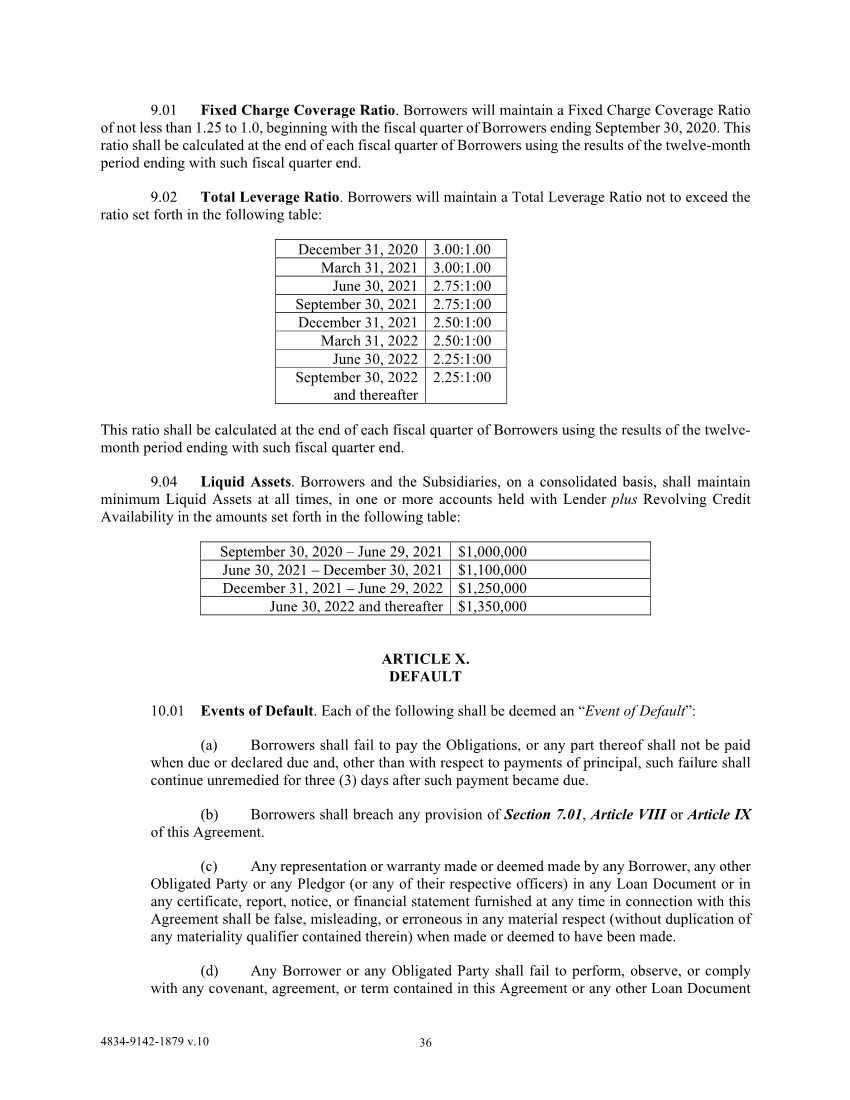

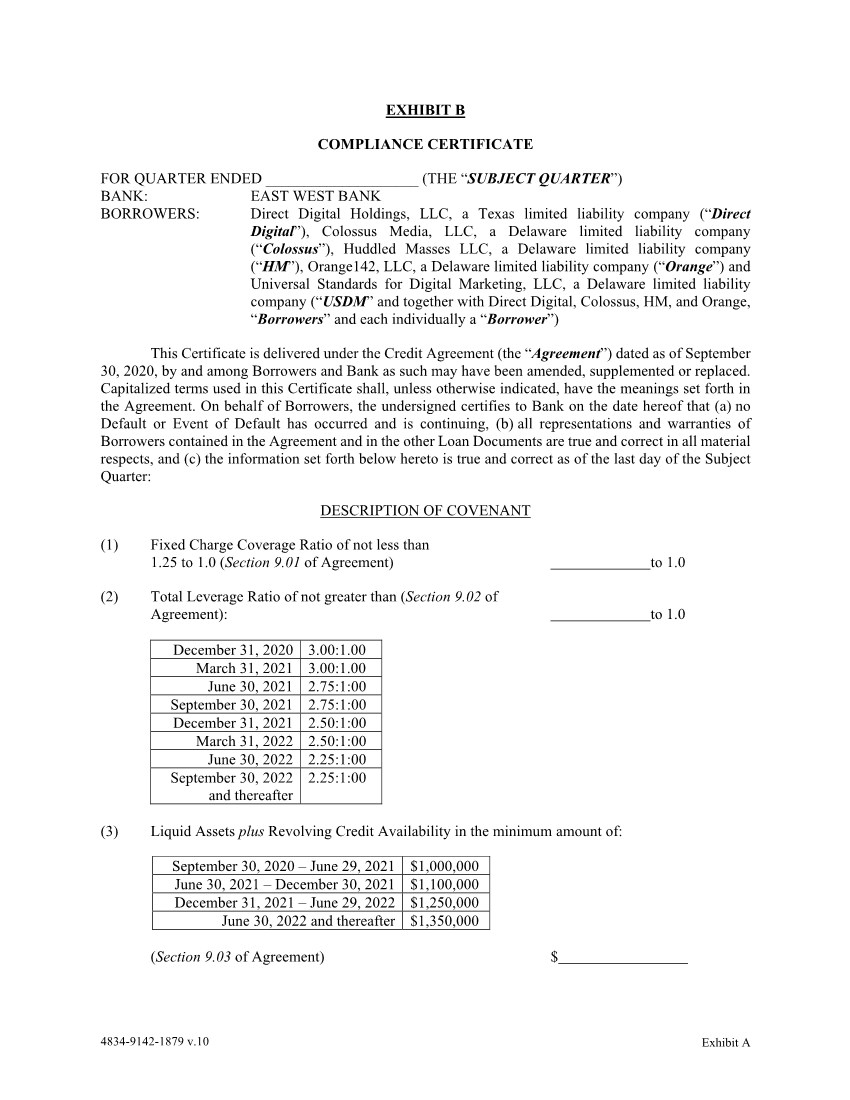

| 4834-9142-1879 v.10 ii ARTICLE VII. AFFIRMATIVE COVENANTS ...................................................................................... 29 7.01 Reporting Requirements ............................................................................................... 29 7.02 Maintenance of Existence; Conduct of Business ......................................................... 30 7.03 Maintenance of Properties ............................................................................................ 30 7.04 Taxes and Claims ........................................................................................................... 30 7.05 Insurance. ....................................................................................................................... 31 7.06 Inspection Rights ............................................................................................................ 31 7.07 Keeping Books and Records ......................................................................................... 31 7.08 Compliance with Laws .................................................................................................. 32 7.09 Compliance with Agreements ....................................................................................... 32 7.10 Further Assurances ........................................................................................................ 32 7.11 ERISA ............................................................................................................................. 32 7.12 Depository Relationship ................................................................................................ 32 7.13 Subsidiaries..................................................................................................................... 32 7.14 Keepwell .......................................................................................................................... 32 ARTICLE VIII. NEGATIVE COVENANTS ........................................................................................... 33 8.01 Debt ................................................................................................................................. 33 8.02 Limitation on Liens ........................................................................................................ 33 8.03 Mergers, Etc ................................................................................................................... 33 8.04 Restricted Payments ...................................................................................................... 33 8.05 Loans and Investments .................................................................................................. 34 8.06 Limitation on Issuance of Equity.................................................................................. 34 8.07 Transactions with Affiliates .......................................................................................... 34 8.08 Disposition of Assets ...................................................................................................... 34 8.09 Sale and Leaseback ........................................................................................................ 34 8.10 Nature of Business ......................................................................................................... 34 8.11 Environmental Protection ............................................................................................. 35 8.12 Accounting ...................................................................................................................... 35 8.13 No Negative Pledge ........................................................................................................ 35 8.14 Subsidiaries..................................................................................................................... 35 8.15 Hedge Agreements ......................................................................................................... 35 8.16 OFAC .............................................................................................................................. 35 8.17 Payments under Term Loan Agreement ..................................................................... 35 8.18 Payments on Preferred Equity ..................................................................................... 35 ARTICLE IX. FINANCIAL COVENANTS ............................................................................................. 35 9.01 Fixed Charge Coverage Ratio ....................................................................................... 36 9.02 Total Leverage Ratio ..................................................................................................... 36 9.03 . ........................................................................................................................................ 36 9.04 Liquid Assets .................................................................................................................. 36 ARTICLE X. DEFAULT ........................................................................................................................... 36 10.01 Events of Default ............................................................................................................ 36 10.02 Remedies Upon Default ................................................................................................. 38 10.03 Performance by Lender ................................................................................................. 38 10.04 Equity Cure .................................................................................................................... 39 ARTICLE XI. MISCELLANEOUS .......................................................................................................... 39 11.01 Expenses .......................................................................................................................... 39 11.02 INDEMNIFICATION ................................................................................................... 39 11.03 Limitation of Liability ................................................................................................... 41 11.04 No Duty ........................................................................................................................... 41 |

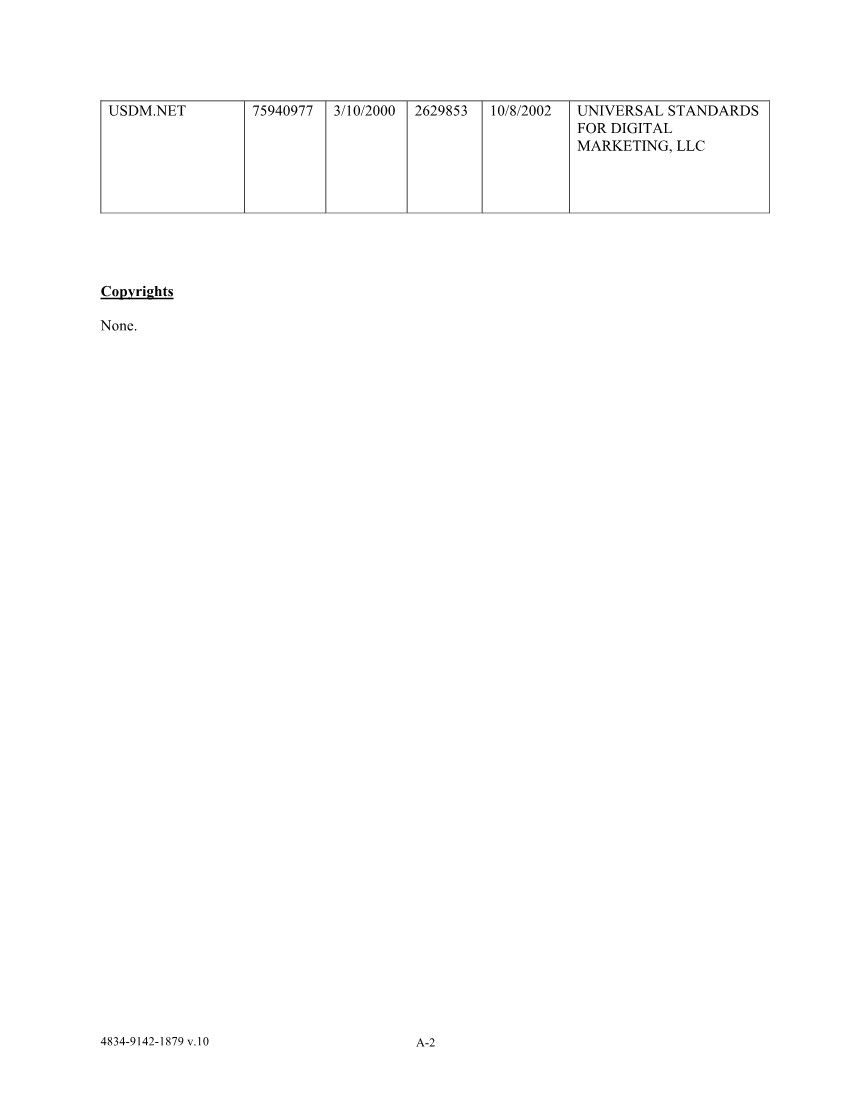

| 4834-9142-1879 v.10 iii 11.05 Lender Not Fiduciary .................................................................................................... 41 11.06 Equitable Relief .............................................................................................................. 41 11.07 No Waiver; Cumulative Remedies ............................................................................... 41 11.08 Successors and Assigns .................................................................................................. 41 11.09 Survival ........................................................................................................................... 41 11.10 ENTIRE AGREEMENT; AMENDMENT .................................................................. 42 11.11 Notices ............................................................................................................................. 42 11.12 Governing Law; Venue; Service of Process ................................................................. 42 11.13 Counterparts .................................................................................................................. 43 11.14 Severability ..................................................................................................................... 43 11.15 Headings ......................................................................................................................... 43 11.16 Participations, Etc .......................................................................................................... 43 11.17 Construction ................................................................................................................... 43 11.18 Independence of Covenants .......................................................................................... 43 11.19 WAIVER OF JURY TRIAL ......................................................................................... 43 11.20 Additional Interest Provision ........................................................................................ 44 11.21 Ceiling Election .............................................................................................................. 45 11.22 USA Patriot Act Notice .................................................................................................. 45 11.01 Intercreditor Legend. .................................................................................................... 45 SCHEDULES 6.13 Subsidiaries, Ventures, Etc. 6.18 Intellectual Property 8.01 Existing Debt 8.02 Existing Liens 8.05 Existing Investments EXHIBITS A. Borrowing Base Report 1.01 B. Compliance Certificate 1.01 C. Revolving Credit Note 2.01 |

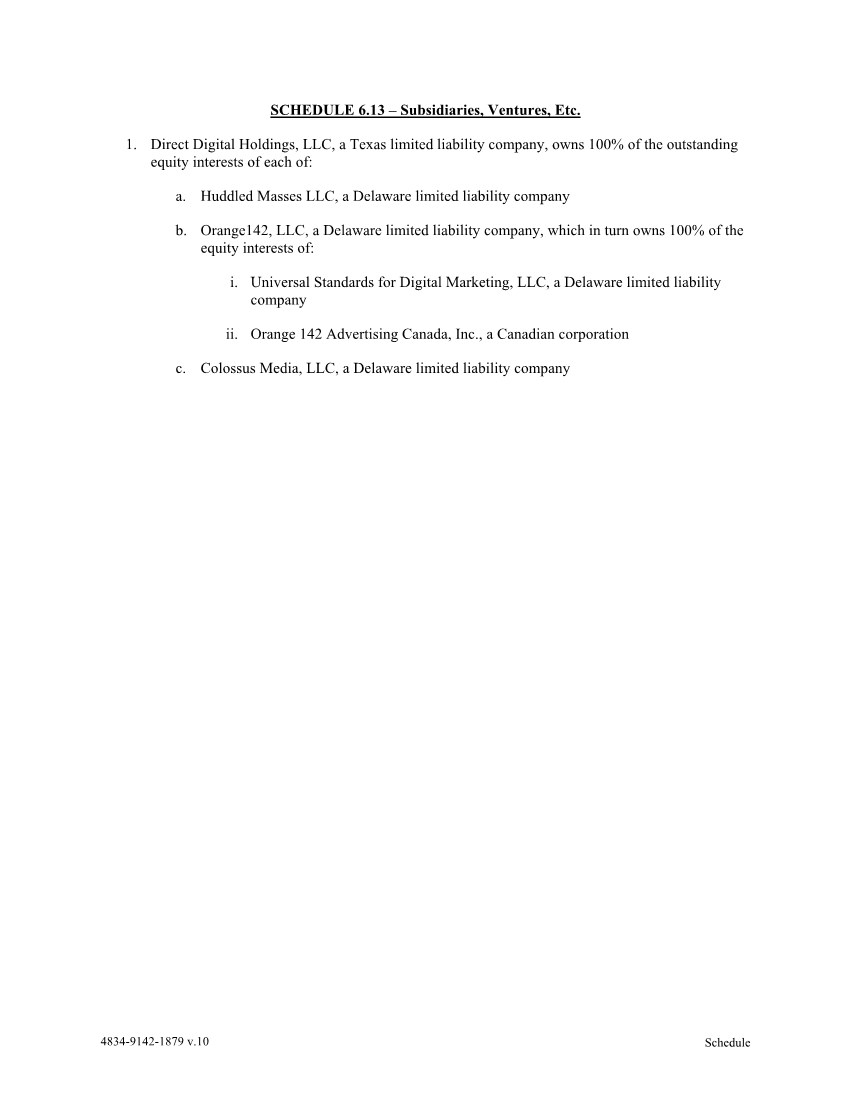

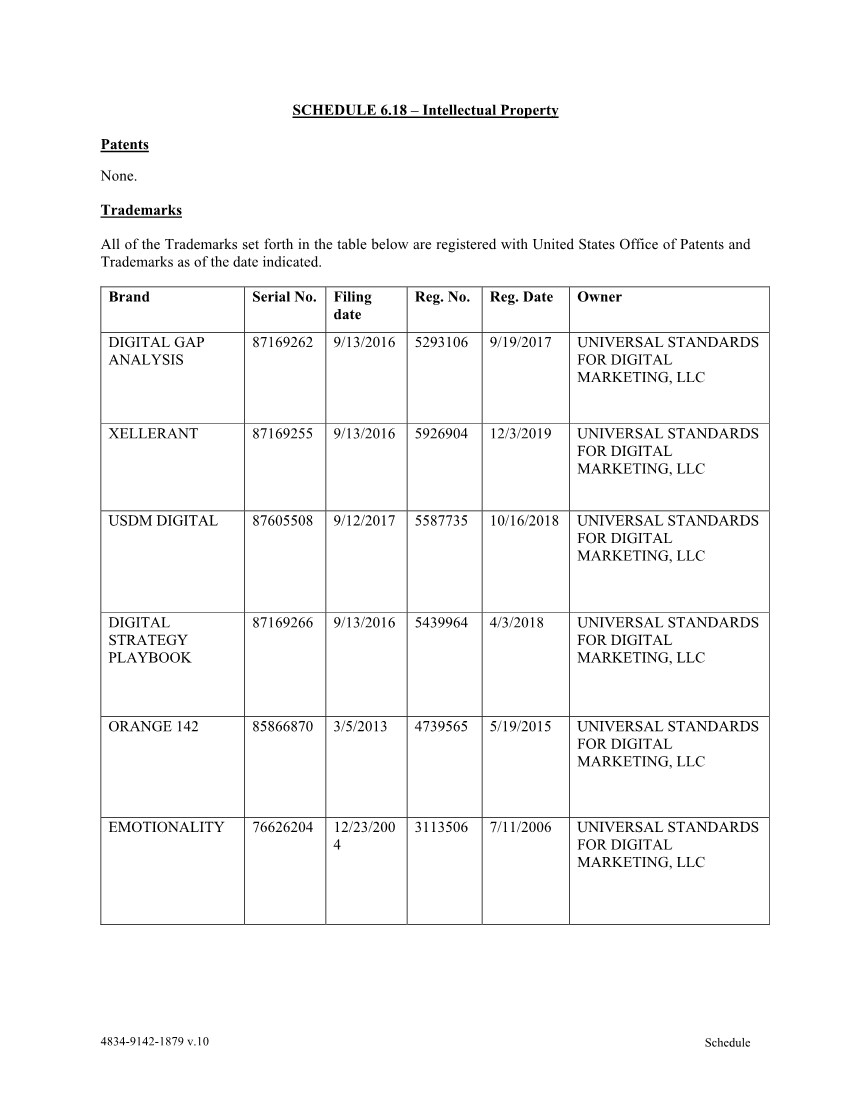

| 4834-9142-1879 v.10 CREDIT AGREEMENT THIS CREDIT AGREEMENT (this “Agreement”), dated as of September 30, 2020 is by and among Direct Digital Holdings, LLC, a Texas limited liability company (“Direct Digital”), Colossus Media, LLC, a Delaware limited liability company (“Colossus”), Huddled Masses LLC, a Delaware limited liability company (“HM”), Orange142, LLC, a Delaware limited liability company (“Orange”) and Universal Standards for Digital Marketing, LLC, a Delaware limited liability company (“USDM” and together with Direct Digital, Colossus, HM, and Orange, “Borrowers” and each individually a “Borrower”), and East West Bank, a California state bank (“Lender”). RECITALS: Borrowers have requested that Lender extend credit to Borrowers as described in this Agreement. Lender is willing to make such credit available to Borrowers upon and subject to the provisions, terms and conditions hereinafter set forth. NOW THEREFORE, in consideration of the premises and the mutual covenants herein contained, the parties hereto agree as follows: ARTICLE I. DEFINITIONS 1.01 Definitions. As used in this Agreement, all exhibits, appendices and schedules hereto and in any note, certificate, report or other Loan Documents made or delivered pursuant to this Agreement, the following terms will have the meanings given such terms in this Article I or in the provision, section or recital referred to below: “Acquisition” means the acquisition by any Person of (a) a majority of the Equity Interests of another Person, (b) all or substantially all of the assets of another Person or (c) all or substantially all of a business unit or line of business of another Person, in each case (i) whether or not involving a merger or consolidation with such other Person and (ii) whether in one transaction or a series of related transactions. “Advance” means an advance by Lender to Borrowers pursuant to Article II. “Advance Request Form” means a certificate, in a form approved by Lender, properly completed and signed by Borrowers requesting a Revolving Credit Advance. “Affiliate” means, as to any Person, any other Person (a) that directly or indirectly, through one or more intermediaries, controls or is controlled by, or is under common control with, such Person; (b) that directly or indirectly beneficially owns or holds five percent (5%) or more of any class of voting stock of such Person; or (c) five percent (5%) or more of the voting stock of which is directly or indirectly beneficially owned or held by the Person in question. The term “control” means the possession, directly or indirectly, of the power to direct or cause direction of the management and policies of a Person, whether through the ownership of voting securities, by contract, or otherwise; provided, however, in no event shall Lender be deemed an Affiliate of Borrowers or any of their Affiliates or the Subsidiaries. “Agreement” has the meaning set forth in the Introductory Paragraph hereto, as the same may, from time to time, be amended, modified, restated, renewed, waived, supplemented, or otherwise changed, and includes all schedules, exhibits and appendices attached or otherwise identified therewith. |

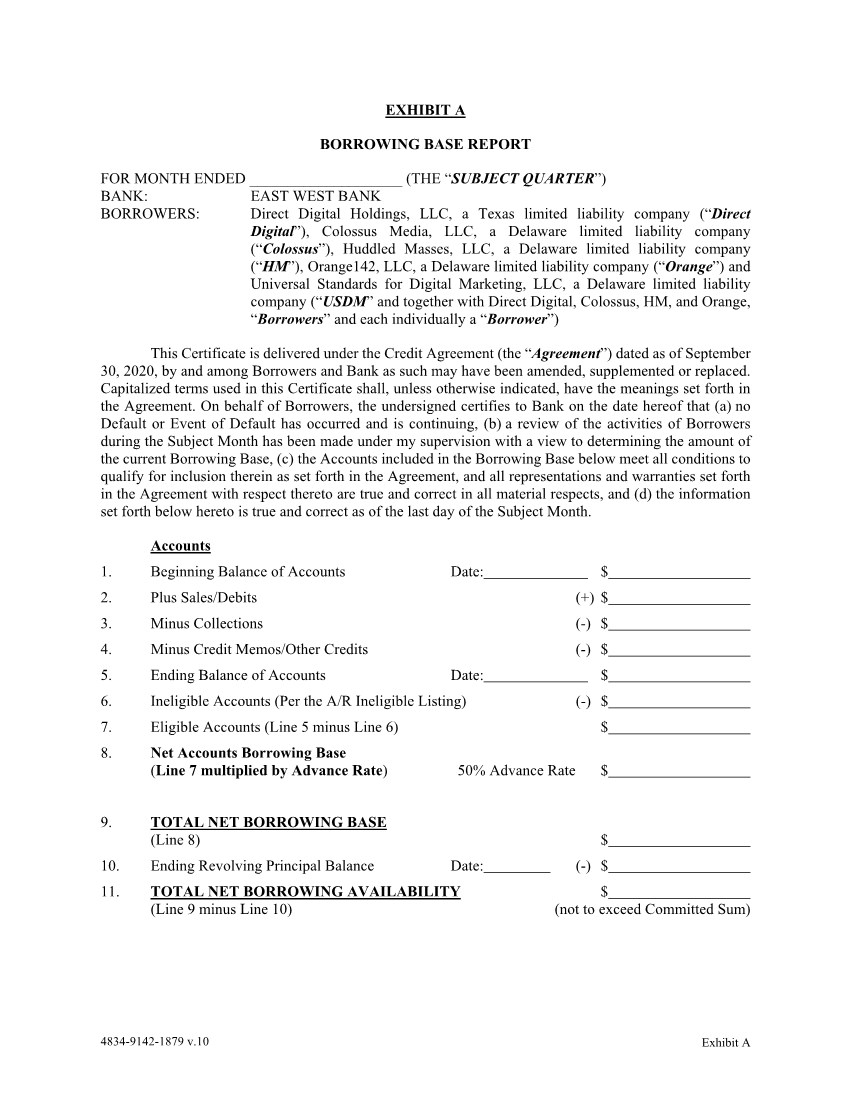

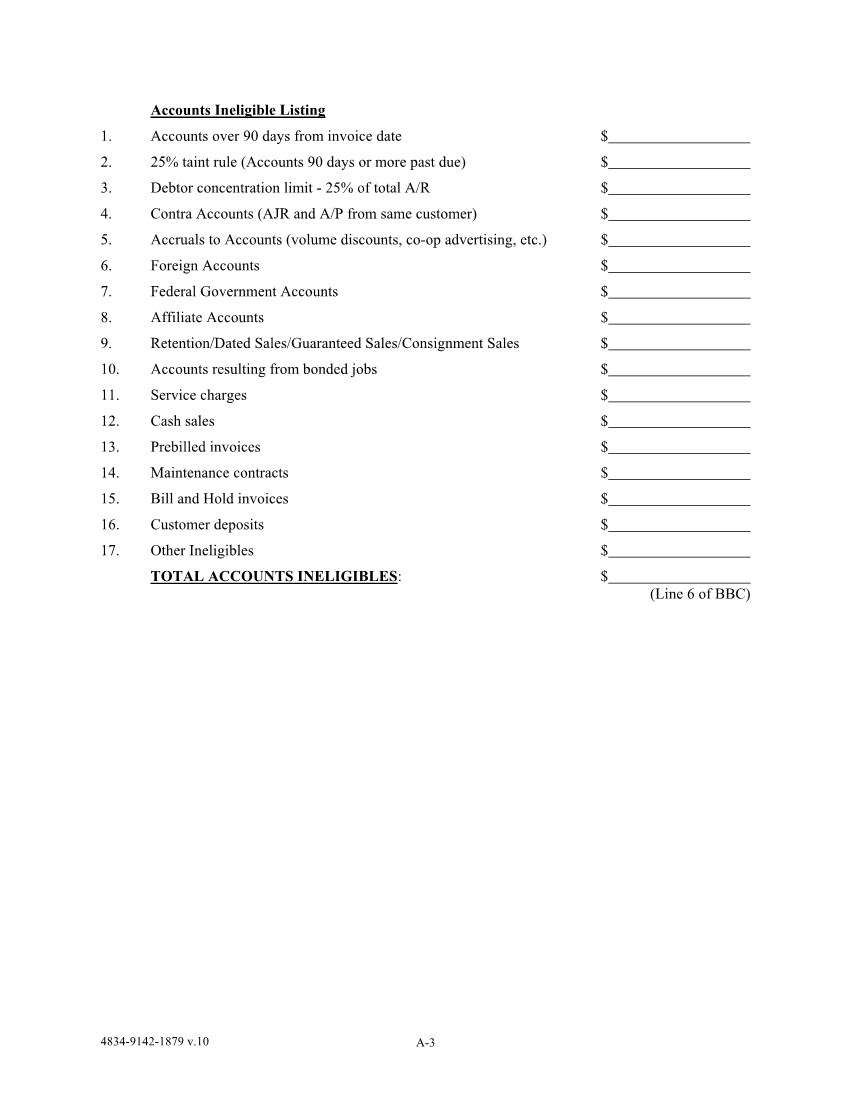

| 4834-9142-1879 v.10 2 “Beneficial Ownership Certification” means a certification regarding beneficial ownership required by the Beneficial Ownership Regulation, which certification shall be substantially in form and substance satisfactory to Lender. “Beneficial Ownership Regulation” means 31 C.F.R. §1010.230. “Borrowers” means the Persons identified as such in the Introductory Paragraph hereof, and their successors and assigns, and “Borrower” means any one of the Borrowers. “Borrowing Base” means, at any time, an amount equal to the lesser of (a) $1,000,000 (the “Initial Borrowing Cap”) or (b) the sum of fifty percent (50%) of the value of Eligible Accounts. Notwithstanding the foregoing, if the Lender and the Term Loan Lender expressly consent in writing, the Initial Borrowing Cap may be removed. “Borrowing Base Report” means, as of any date of preparation, a certificate setting forth the Borrowing Base (in a form acceptable to Lender in substantially the form of Exhibit A attached hereto) prepared by and certified by a Responsible Officer of Borrower. “Business Day” means any day other than a Saturday or a Sunday or any day on which commercial banks in Los Angeles, California, are authorized or required to close, and, if the applicable Business Day relates to a LIBOR Amount, such day also must be a day on which U.S. Dollar deposits are traded by and between banks in the London interbank Eurodollar market. “Capital Expenditure” shall mean any expenditure by a Person for (a) an asset which will be used in a year or years subsequent to the year in which the expenditure is made and which asset is properly classified in relevant financial statements of such Person as equipment, real property, a fixed asset or a similar type of capitalized asset in accordance with GAAP or (b) an asset relating to or acquired in connection with an acquired business, and any and all acquisition costs related to (a) or (b) above. “Capitalized Lease Obligation” shall mean the amount of Debt under a lease of Property by a Person that would be shown as a liability on a balance sheet of such Person prepared for financial reporting purposes in accordance with GAAP. “Cash and Cash Equivalents” shall mean, with respect to any Person, an unrestricted or unencumbered (A) cash and (B) any of the following: (x) marketable direct obligations issued or unconditionally guaranteed by the United States Government or issued by an agency thereof and backed by the full faith and credit of the United States; (y) marketable direct obligations issued by any state of the United States of America or any political subdivision of any such state or any public instrumentality thereof which, at the time of acquisition, has one of the two highest ratings obtainable from any two of S&P Global Ratings, Moody’s Investors Service, Inc. or Fitch Investors (or, if at any time no two of the foregoing shall be rating such obligations, then from such other nationally recognized rating services as may be acceptable to Lender) and is not listed for possible down-grade in any publication of any of the foregoing rating services; (z) domestic certificates of deposit or domestic time deposits or repurchase agreements issued by any commercial bank organized under the laws of the United States of America or any state thereof or the District of Columbia having combined capital and surplus of not less than $500,000,000.00, which commercial bank has a rating of at least either “AA” or such comparable rating from S&P Global Ratings or Moody’s Investors Service, Inc., respectively; (aa) money market funds having assets under management in excess of $1,000,000,000.00; (bb) any unrestricted stock, shares, certificates, bonds, debentures, notes or other instrument which constitutes a “security” under the Security Act of 1993, which are freely tradable on any nationally recognized securities exchange and are not otherwise encumbered by such transferee; (cc) lines of credit; (dd) unfunded, but unconditionally committed and unencumbered capital commitments |

| 4834-9142-1879 v.10 3 of the direct or indirect members or limited partners of such Person (or, to the extent encumbered by a subscription facility (or the like), such capital commitments, less any amounts drawn and outstanding under a subscription facility (or the like)) or such other assets or properties as Lender may (in its sole discretion) deem acceptable as evidenced by Lender’s written confirmation, excluding any and all retirement accounts and deferred profit-sharing accounts. To constitute “Cash and Cash Equivalents” the foregoing items described in (A) and (B) above must be: (i) owned solely in the name of such Person or its wholly owned direct or indirect subsidiaries, as set forth on such Person’s balance sheet (and not jointly with any other person or entity) in a non-margin account identified as being owned by solely in the name of such Person or its wholly owned direct or indirect subsidiaries, as set forth on such Person’s balance sheet; and (ii) free and clear of any lien, security interest, assignment, right of setoff or other encumbrance of any kind except Permitted Liens hereof. For any purpose of determination hereunder, the amount of “Cash and Cash Equivalents” shall be reduced by outstanding unsecured debt (under revolving lines of credit or otherwise) of any one or more of the person/trusts which comprise such Person. “Cash Flow Available for Debt Service” means, for Borrowers and the Subsidiaries, on a consolidated basis, for any period, (a) EBITDA, minus (b) cash taxes paid or payable or Permitted Tax Distributions made during such period, minus (c) all Capital Expenditures not financed with Debt permitted hereunder during such period, minus (d) distributions. “Change in Control” means any reorganization, recapitalization, consolidation or merger (or similar transaction or series of related transactions) of any Borrower, any sale or exchange of outstanding shares or other Equity Interests (or similar transaction or series of related transactions) of any Borrower or any other transaction or series of transactions, as a result of which (i) Mark Walker and Keith Smith (together with members of their immediate families) collectively do not own a majority of the common equity interest in and more than 50% of the voting power of, and control, the surviving entity of such transaction or series of related transactions (or the parent of such surviving entity if such surviving entity is wholly owned by such parent), in each case without regard to whether a Borrower is the surviving entity, and own and control directly or indirectly a majority of the Equity Interests in and more than 50% of the voting power of, and control, each Borrower, or (ii) any other Person or group acquires, directly or indirectly, more than 50% of the voting power, or control, of any Borrower, it being understood that any change in composition of the Board of Direct Digital as contemplated by the Operating Agreement of Direct Digital as in effect as of the date hereof shall not constitute a Change in Control. “Code” means the Internal Revenue Code of 1986, as amended, and the regulations promulgated and rulings issued thereunder. “Collateral” means all property and assets granted as collateral security for the Obligations, whether real or personal property, whether granted directly or indirectly, whether granted now or in the future, and whether granted in the form of a security interest, mortgage, collateral mortgage, deed of trust, assignment, pledge, crop pledge, chattel mortgage, collateral chattel mortgage, chattel trust, factor's lien, equipment trust, conditional sale, trust receipt, lien, charge, lien or title retention contract, lease or consignment intended as a security device, or any other security or lien interest or Hedge Agreement whatsoever, whether created by law, contract, or otherwise. “Commitment” means the obligation of Lender to make Revolving Credit Advances pursuant to Section 2.01 in an aggregate principal amount up to but not exceeding Four Million Five Hundred Thousand Dollars ($4,500,000), subject to termination pursuant to Section 10.02. “Commitment Fee” means Forty-Five Thousand and No/100 Dollars ($45,000). |

| 4834-9142-1879 v.10 4 “Commodity Exchange Act” means the Commodity Exchange Act (7 U.S.C. §1 et seq.), and any successor statute. “Compliance Certificate” means a certificate, substantially in the form of Exhibit B attached hereto, prepared by and executed by an officer of Borrowers. “Constituent Documents” means (i) in the case of a corporation, its articles or certificate of incorporation and bylaws; (ii) in the case of a general partnership, its partnership agreement and certificate of formation or other instrument filed in connection with its formation; (iii) in the case of a limited partnership, its certificate of limited partnership and partnership agreement; (iv) in the case of a trust, its trust agreement; (v) in the case of a joint venture, its joint venture agreement; (vi) in the case of a limited liability company, its articles of organization and operating agreement or regulations; and (vii) in the case of any other entity, its organizational and governance documents and agreements. “Debt” means as to any Person at any time (without duplication): (a) all obligations of such Person for borrowed money, (b) all obligations of such Person evidenced by bonds, notes, debentures, or other similar instruments, (c) all obligations of such Person to pay the deferred purchase price of property or services, except trade accounts payable of such Person arising in the ordinary course of business that are not past due by more than ninety (90) days, (d) all Capitalized Lease Obligations of such Person, (e) all Debt or other obligations of others Guaranteed by such Person, (f) all obligations secured by a Lien existing on property owned by such Person, whether or not the obligations secured thereby have been assumed by such Person or are non-recourse to the credit of such Person, (g) any other obligation for borrowed money or other financial accommodations which in accordance with GAAP would be shown as a liability on the balance sheet of such Person, (h) any repurchase obligation or liability of a Person with respect to accounts, chattel paper or notes receivable sold by such Person, (i) any liability under a sale and leaseback transaction that is not a Capitalized Lease Obligation, (j) any obligation under any so-called “synthetic leases”, (k) any obligation arising with respect to any other transaction that is the functional equivalent of borrowing but which does not constitute a liability on the balance sheets of a Person, (l) all reimbursement obligations of such Person (whether contingent or otherwise) in respect of letters of credit, bankers’ acceptances, surety or other bonds and similar instruments, and (m) all liabilities of such Person in respect of unfunded vested benefits under any Plan. “Debt Service” means, for any Person as of any date of determination, the sum of (a) the current portion of long-term Debt of such Person and (b) all regularly scheduled interest payments that are paid in cash with respect of all Debt of such Person for the trailing twelve-month period ending on the date of determination. “Default” means an Event of Default or the occurrence of an event or condition which with notice or lapse of time or both would become an Event of Default. “Default Interest Rate” means a rate per annum equal to the Loan Rate plus five percent (5%), but in no event in excess of the Maximum Lawful Rate. “Delaware LLC” means any limited liability company organized or formed under the laws of the State of Delaware. “Delaware LLC Division” means the statutory division of any Delaware LLC into two or more Delaware LLCs pursuant to Section 18-217 of the Delaware Limited Liability Company Act. “Designated Jurisdiction” means any country or territory to the extent that such country or territory itself is the subject of any Sanction. -- |

| 4834-9142-1879 v.10 5 “Dollars” and “$” mean lawful money of the United States of America. “Domestic Subsidiary” means any Subsidiary that is organized under the laws of any political subdivision of the United States of America. “EBITDA” means, for Borrowers and their Subsidiaries on a consolidated basis for any period in question, the sum of (a) Net Income for such period plus (b) to the extent deducted in determining such Net Income, the sum, without duplication, of (i) Interest Expense during such period, (ii) all federal, state, local and/or foreign income taxes payable by Borrowers and their Subsidiaries during such period, (iii) depreciation expenses of Borrowers and their Subsidiaries during such period, (iv) amortization expenses of Borrowers and their Subsidiaries during such period, (v) management fees payable under and pursuant to the Board Services and Consulting Agreements each dated as of September 30, 2020, by and between DDH, on the one hand, and Keith Smith and Mark Walker, respectively, on the other hand (not to exceed in aggregate amount $900,000 per annum or $225,000 per quarter for purposes of this definition), and (vi) non-recurring legal, consulting expenses in an amount up to $250,000 during any 12 month period and minus (c) any extraordinary, non-recurring and/or non-cash gains or income during such period as reported in the monthly and annual financials of Borrowers and their Subsidiaries, all determined on a consolidated basis. “Eligible Accounts” means, at any time, all accounts receivable of Borrowers and their Subsidiaries that are Guarantors created in the ordinary course of business that are acceptable to Lender in its Permitted Discretion and satisfy the following conditions: (a) The account complies with all applicable laws, rules, and regulations, including, without limitation, usury laws, the Federal Truth in Lending Act, and Regulation Z of the Board of Governors of the Federal Reserve System; (b) The account has not been outstanding for more than ninety (90) days past the original date of invoice; (c) The account does not represent a commission and the account was created in connection with (i) the sale of goods by a Borrower or a Subsidiary in the ordinary course of business and such sale has been consummated and such goods have been shipped and delivered and received by the account debtor, or (ii) the performance of services by a Borrower or a Subsidiary in the ordinary course of business and such services have been completed and accepted by the account debtor; (d) The account arises from an enforceable contract, the performance of which has been completed by a Borrower or a Subsidiary; (e) The account does not arise from the sale of any good that is on a bill-and-hold, guaranteed sale, sale-or-return, sale on approval, consignment, or any other repurchase or return basis; (f) A Borrower or a Subsidiary has good and indefeasible title to the account and the account is not subject to any Lien except Liens in favor of Lender and Term Loan Lender; (g) The account does not arise out of a contract with or order from, an account debtor that, by its terms, prohibits or makes void or unenforceable the grant of a security interest by a Borrower or a Subsidiary to Lender in and to such account; (h) The account is not subject to any setoff, counterclaim, defense, dispute, recoupment, or adjustment other than normal discounts for prompt payment; |

| 4834-9142-1879 v.10 6 (i) The account debtor is not insolvent or the subject of any bankruptcy or insolvency proceeding and has not made an assignment for the benefit of creditors, suspended normal business operations, dissolved, liquidated, terminated its existence, ceased to pay its debts as they become due, or suffered a receiver or trustee to be appointed for any of its assets or affairs; (j) The account is not evidenced by chattel paper or an instrument; (k) No default exists under the account by any party thereto beyond any applicable notice and cure period; (l) The account debtor has not returned or refused to retain, or otherwise notified a Borrower or a Subsidiary of any dispute concerning, or claimed nonconformity of, any of the goods from the sale of which the account arose; (m) The account is not owed by an Affiliate, employee, officer, director or shareholder of any Borrower or a Subsidiary; (n) The account is payable in Dollars by the account debtor; (o) The account is not owed by an account debtor whose accounts Lender in its Permitted Discretion has chosen to exclude from Eligible Accounts; (p) The account shall be ineligible if the account debtor is domiciled in any country other than the United States of America and/or Canada; (q) The account shall be ineligible if more than twenty-five percent (25%) of the aggregate balances then outstanding on accounts owed by such account debtor and its Affiliates to any Borrower or a Subsidiary are more than ninety (90) days past the dates of their original invoices; (r) The account shall be ineligible if the account debtor is the United States of America or any department, agency, or instrumentality thereof, and the Federal Assignment of Claims Act of 1940, as amended, shall not have been complied with; (s) The account shall be ineligible to the extent the aggregate of all accounts owed by the account debtor and its Affiliates to which the account relates exceeds twenty-five percent (25%) of all accounts owed by all of Borrower’s and its Subsidiaries’ account debtors; and (t) The Account is otherwise acceptable in the Permitted Discretion of Lender; provided that Lender shall have the right to create and adjust eligibility standards and related reserves from time to time in its Permitted Discretion. The amount of the Eligible Accounts owed by an account debtor to Borrower or a Subsidiary shall be reduced by the amount of all “contra accounts” and other obligations owed by Borrower or a Subsidiary to such account debtor. “Environmental Laws” means any and all federal, state, and local laws, regulations, judicial decisions, orders, decrees, plans, rules, permits, licenses, and other governmental restrictions and requirements pertaining to health, safety, or the environment, including, without limitation, the Comprehensive Environmental Response, Compensation and Liability Act of 1980, 42 U.S.C. §9601 et seq., the Resource Conservation and Recovery Act of 1976, 42 U.S.C. §6901 et seq., the Occupational Safety and Health Act, 29 U.S.C. §651 et seq., the Clean Air Act, 42 U.S.C. §7401 et seq., the Clean Water |

| 4834-9142-1879 v.10 7 Act, 33 U.S.C. §1251 et seq., and the Toxic Substances Control Act, 15 U.S.C. §2601 et seq., as the same may be amended or supplemented from time to time. “Environmental Liabilities” means, as to any Person, all liabilities, obligations, responsibilities, Remedial Actions, losses, damages, punitive damages, consequential damages, treble damages, costs, and expenses, (including, without limitation, all reasonable fees, disbursements and expenses of counsel, expert and consulting fees and costs of investigation and feasibility studies), fines, penalties, sanctions, and interest incurred as a result of any claim or demand, by any Person, whether based in contract, tort, implied or express warranty, strict liability, criminal or civil statute, including any Environmental Law, permit, order or agreement with any Governmental Authority or other Person, arising from environmental, health or safety conditions or the Release or threatened Release of a Hazardous Material into the environment, resulting from the past, present, or future operations of such Person or its Affiliates. “Equity Cure” means the cash contributions made to Direct Digital in immediately available funds by one or more holders of Equity Interests therein as additional common equity contributions to Direct Digital and which are designated an “Equity Cure” by Direct Digital under Section 10.04 at the time contributed. “Equity Interests” means, with respect to any Person, all of the shares of capital stock of (or other ownership or profit interests in) such Person, all of the warrants, options or other rights for the purchase or acquisition from such Person of shares of capital stock of (or other ownership or profit interests in) such Person, all of the securities convertible into or exchangeable for shares of capital stock of (or other ownership or profit interests in) such Person or warrants, rights or options for the purchase or acquisition from such Person of such shares (or such other interests), and all of the other ownership or profit interests in such Person (including partnership, member or trust interests therein), whether voting or nonvoting, and whether or not such shares, warrants, options, rights or other interests are outstanding on any date of determination. “ERISA” means the Employee Retirement Income Security Act of 1974, as amended from time to time, and the regulations and published interpretations thereunder. “ERISA Affiliate” means any corporation or trade or business which is a member of the same controlled group of corporations (within the meaning of Section 414(b) of the Code) as any Borrower or is under common control (within the meaning of Section 414(c) of the Code) with any Borrower. “Event of Default” has the meaning specified in Section 10.01. “Excluded Account” means any deposit account (including, for the avoidance of doubt, any cash, cash equivalents or other property contained therein): (i) solely to the extent, and for so long as, such deposit account is pledged to secure performance of obligations arising under clause (vi) of the defined term “Permitted Liens”, and whether such pledge is by escrow or otherwise, in all cases with a balance no greater than such obligations under clause (vi) of the defined term “Permitted Liens”; (ii) used exclusively for payroll, payroll taxes and other employee wage and benefit payments with a balance no greater than such payroll, payroll taxes and other employee wage and benefit payments obligations that are to be paid within any two-week period; (iii) constituting a “zero balance” deposit account; or (iv) consisting of a disbursement account established with a payment processor to process vendor payments so long as the average monthly balance in such account does not exceed $250,000 at any one time. “Excluded Hedge Obligation” means, with respect to any Obligated Party, any Hedge Obligations if, and to the extent that, all or a portion of such Obligated Party’s Guarantee of (whether such Guarantee arises pursuant to a Guaranty, by such Obligated Party’s being jointly and severally liable for such Hedge |

| 4834-9142-1879 v.10 8 Obligations, or otherwise (any such Guarantee, an “Applicable Guarantee”)), or the grant by such Obligated Party of a security interest to secure, such Hedge Obligations (or any Applicable Guarantee thereof) is or becomes illegal or unlawful under the Commodity Exchange Act or any rule, regulation or order of the Commodity Futures Trading Commission (or the application or official interpretation of any thereof) by virtue of such Obligated Party’s failure for any reason not to constitute an Eligible Contract Participant (as defined in the Commodity Exchange Act), and any and all Guarantees of such Obligated Parties’ Hedge Obligations by other Obligated Parties at the time the Applicable Guarantee of such Obligated Party or the grant of such security interest becomes effective with respect to such related Hedge Obligations. If any Hedge Obligations arise under a Master Agreement governing more than one Hedge Agreement, then such exclusion shall apply only to the portion of such Hedge Obligations that is attributable to Hedge Agreements for which such Applicable Guarantee or security interest is or becomes illegal. “Excluded Taxes” means (a) backup withholding taxes, (b) franchise taxes, (c) taxes imposed on or measured by net income (however denominated), in each case, (i) imposed on (or measured by) Lender’s net income by the jurisdiction under the laws of which Lender is organized or in which its principal office is located or in which its applicable lending office is located or (ii) that are taxes imposed as a result of a present or former connection between Lender and the jurisdiction imposing such tax (other than connections arising from Lender having executed, delivered, become a party to, performed its obligations under, received payments under, received or perfected a security interest under, or engaged in any other transaction pursuant to or enforced any Loan Document or sold or assigned an interest in any Advance, and (d) taxes attributable to Lender’s failure to provide Borrowers with any forms or other documentation required by applicable law or reasonably requested by Borrowers in order for Borrowers to determine whether or not payments pursuant to any Loan Document are subject to withholding or information reporting requirements. “Fixed Charge Coverage Ratio” means the ratio of (a) Cash Flow Available for Debt Service for the trailing twelve-month period ending on the date of determination, to (b) Debt Service, in each case for Borrowers and the Subsidiaries on a consolidated basis. “Funding Loss” means the amount (which shall be payable on demand by Lender) necessary to promptly compensate Lender for, and hold it harmless from, any loss, cost or expense incurred by Lender as a result of: (a) any payment or prepayment of any LIBOR Amount on a day other than the last day of the relevant LIBOR Interest Period (whether voluntary, mandatory, automatic, by reason of acceleration, or otherwise); or (b) any failure by Borrowers to borrow a LIBOR Amount bearing or selected to bear interest based upon LIBOR on the date or in the amount selected by Borrowers; including any loss of anticipated profits and any loss or expense arising from the liquidation or reemployment of funds obtained by it to maintain such LIBOR Amount or from fees payable to terminate the deposits from which such funds were obtained. Borrowers shall also pay any customary administrative fees charged by Lender in connection with the foregoing. For purposes of calculating amounts payable by Borrowers to Lender hereunder, Lender shall be deemed to have funded the LIBOR Amount based upon the LIBOR Rate by a matching deposit or other borrowing in the London inter-bank market for a comparable amount and for a comparable period, whether or not such LIBOR Amount was in fact so funded. “GAAP” means generally accepted accounting principles, applied on a consistent basis, as set forth in Opinions of the Accounting Principles Board of the American Institute of Certified Public Accountants and/or in statements of the Financial Accounting Standards Board and/or their respective successors and |

| 4834-9142-1879 v.10 9 which are applicable in the circumstances as of the date in question. Accounting principles are applied on a “consistent basis” when the accounting principles applied in a current period are comparable in all material respects to those accounting principles applied in a preceding period. “Governmental Authority” means any nation or government, any state or political subdivision thereof and any entity exercising executive, legislative, judicial, regulatory, or administrative functions of or pertaining to government. “Guarantee” by any Person means any obligation, contingent or otherwise, of such Person directly or indirectly guaranteeing any Debt or other obligation of any other Person as well as any obligation or liability, direct or indirect, contingent or otherwise, of such Person (a) to purchase or pay (or advance or supply funds for the purchase or payment of) such Debt or other obligation or liability (whether arising by virtue of partnership arrangements, by agreement to keep-well, to purchase assets, goods, securities or services, to operate Property, to take-or-pay, or to maintain net worth or working capital or other financial statement conditions or otherwise) or (b) entered into for the purpose of indemnifying or assuring in any other manner the obligee of such Debt or other obligation or liability of the payment thereof or to protect the obligee against loss in respect thereof (in whole or in part), provided that the term Guarantee shall not include endorsements for collection or deposit in the ordinary course of business. The term “Guarantee” used as a verb has a corresponding meaning. “Guarantor” means any Person who from time to time guarantees all or any part of the Obligations, including, the Subsidiary Guarantors. “Guaranty” means a written guaranty of each Guarantor in favor of Lender, in form and substance satisfactory to Lender, as the same may be amended, modified, restated, renewed, replaced, extended, supplemented or otherwise changed from time to time. “Hazardous Material” means any substance, product, waste, pollutant, material, chemical, contaminant, constituent, or other material which is or becomes listed, regulated, or addressed under any Environmental Law, including, without limitation, asbestos, petroleum, and polychlorinated biphenyls. “Hedge Agreement” means (a) any and all interest rate swap transactions, basis swaps, credit derivative transactions, forward rate transactions, commodity swaps, commodity options, forward commodity contracts, equity or equity index swaps or options, bond or bond price or bond index swaps or options or forward bond or forward bond price or forward bond index transactions, interest rate options, forward foreign exchange transactions, cap transactions, floor transactions, collar transactions, currency swap transactions, cross-currency rate swap transactions, currency options, spot contracts, or any other similar transactions or any combination of any of the foregoing (including any options to enter into any of the foregoing), whether or not any such transaction is governed by or subject to any master agreement, (b) any and all transactions of any kind, and the related confirmations, which are subject to the terms and conditions of, or governed by, any form of master agreement published by the International Swaps and Derivatives Association, Inc., any International Foreign Exchange Master Agreement, or any other master agreement (any such master agreement, together with any related schedules and annexes, a “Master Agreement”) and (c) any and all Master Agreements and any and all related confirmations. “Hedge Bank” means any Person that, at the time it enters into an interest rate Hedge Agreement permitted under this Agreement, is Lender or an Affiliate of Lender, in its capacity as a party to such Hedge Agreement. “Hedge Obligations” means, for any Person, any and all obligations (whether absolute or contingent and howsoever and whensoever created) of such Person to pay or perform under any agreement, |

| 4834-9142-1879 v.10 10 contract or transaction that constitutes a “swap” within the meaning of Section 1a(47) of the Commodity Exchange Act arising, evidenced or acquired under (a) any and all Hedging Agreements, (b) any and all cancellations, buy backs, reversals, terminations or assignments of any Hedging Agreements, and (c) any and all renewals, extensions and modifications of any Hedging Agreements and any and all substitutions of any Hedging Agreements. “Huddled Masses Notes” means, collectively (i) that certain Promissory Note dated June 21, 2018, by and between HMC Operations, LLC, a Texas limited liability company and Cantu Holdings, LLC, a Delaware limited liability, in the amount of $250,000.00, with an outstanding balance of $87,500 as of the date hereof, (ii) that certain Promissory Note dated June 21, 2018, by and between HMC Operations, LLC, a Texas limited liability company, Charles Cantu, a New York resident, Kristie MacDonald, Amy Harris, Laura Ottaviano, Lisa Grisanti, Joseph Riggio, in the amount of $141,203.69, (iii) that certain Promissory Note dated June 21, 2018, by and between HMC Operations, LLC, a Texas limited liability company, and Devon White, a New York resident, in the amount of $21,990.74, and (iv) that certain Promissory Note dated June 21, 2018, by and between HMC Operations, LLC, a Texas limited liability company, and MediaMath, Inc., a Delaware corporation, in the amount of $64,814.81. “Intercreditor Agreement” means that certain Intercreditor Agreement of even date herewith, by and among Term Loan Lender and Lender, as amended, restated, supplemented or otherwise modified from time to time. “Interest Expense” means, for any period, the interest expense of Borrowers and their Subsidiaries for the period in question, determined on a consolidated basis and consistent with practices as of the date hereof or otherwise in accordance with GAAP. “Interest Payment Date” means (a) with respect to any principal amount bearing interest based upon the Prime Rate, the first day of each and every calendar month during the term of the Notes and (b) with respect to each LIBOR Amount, the last day of each LIBOR Interest Period applicable to such LIBOR Amount. “Investment” means any beneficial ownership (including stock, partnership or limited liability company interests) of or in any Person, or any loan, advance or capital contribution to any Person or the acquisition of any material assets of another Person, other than equipment purchases made by the Borrower as part of the operation of its business. “Liabilities” means, at any particular time, all amounts which, in conformity with GAAP, would be included as liabilities on a balance sheet of a Person. “LIBOR Amount” means each principal amount for which the LIBOR Rate applies for any specified LIBOR Interest Period. “LIBOR Interest Period” means, for any LIBOR Amount, a period of one month; provided, however, that: (i) the first day of a LIBOR Interest Period must be a Business Day; (ii) no LIBOR Interest Period shall extend beyond the Maturity Date of the Loan under which the LIBOR Amount was made; (iii) no LIBOR Interest Period shall extend beyond the scheduled payment date of any principal payment required by the Loan under which the LIBOR Amount was made; (iv) any LIBOR Interest Period that would otherwise expire on a day that is not a Business Day shall be extended to the next succeeding Business Day, unless the result of such extension would be to extend such LIBOR Interest Period into another calendar month, in which event the LIBOR Interest Period shall end on the immediately preceding Business Day; and (v) any LIBOR Interest Period that begins on the last Business Day of a calendar month |

| 4834-9142-1879 v.10 11 (or on a day for which there is no numerically corresponding day in the calendar month at the end of such LIBOR Interest Period) shall end on the last Business Day of a calendar month. “LIBOR Rate” means, an interest rate equivalent to Lender’s LIBOR Rate which is that rate determined by Lender’s Treasury Desk to be the Interbank lending rate for a period equal to the applicable LIBOR Interest Period which appears on the Bloomberg Screen B TMM Page under the heading “LIBOR Fix” as of 11:00 am (London Time) on the second Business Day prior to the first day of such period (adjusted for any and all assessments, surcharges and reserve requirements). Notwithstanding anything in this definition to the contrary, if LIBOR Rate shall be less than zero, then such rate shall be deemed to be zero for purposes of this Agreement. “Lien” means any lien, mortgage, security interest, tax lien, pledge, charge, hypothecation, assignment, preference, priority, or other encumbrance of any kind or nature whatsoever (including, without limitation, any conditional sale or title retention agreement), whether arising by contract, operation of law, or otherwise. “Liquid Assets” shall mean, with respect to any Person, (a) unencumbered Cash and Cash Equivalents (as defined below) and (b) marketable securities, each valued in accordance with GAAP, consistently applied (or other principles acceptable to Lender), as reasonably determined by such Person and reasonably approved by Lender. “Loan Documents” means this Agreement, the Intercreditor Agreement, the Preferred Equity Subordination Agreement, and all promissory notes, security agreements, pledge agreements, deeds of trust, assignments, letters of credit, guaranties, Hedge Agreements and other instruments, documents, and agreements executed and delivered pursuant to or in connection with this Agreement, as such instruments, documents, and agreements may be amended, modified, renewed, restated, extended, supplemented, replaced, consolidated, substituted, or otherwise changed from time to time. “Loan Rate” means the LIBOR Rate plus 3.50% per annum; provided, that, in no event shall the Loan Rate be less than 0.50% of the Loan Rate effective on the date of this Agreement. “Master Agreement” has the meaning set forth in the definition of “Hedge Agreement.” “Material Adverse Event” means any act, event, condition, or circumstance which could materially and adversely affect: (a) the operations, business, properties, liabilities (actual or contingent), or condition (financial or otherwise) of Borrowers or Borrowers and the Subsidiaries, taken as a whole; (b) the ability of any Obligated Party to perform its obligations under any Loan Document to which it is a party; or (c) the legality, validity, binding effect or enforceability against any Obligated Party of any Loan Document to which it is a party. “Maturity Date” means 3:00 P.M. Dallas, Texas time on September 30, 2022, or such earlier date on which the Commitment terminates as provided in this Agreement. “Maximum Lawful Rate” means, at any time, the maximum rate of interest which may be charged, contracted for, taken, received or reserved by Lender in accordance with applicable Texas law (or applicable United States federal law to the extent that such law permits Lender to charge, contract for, receive or reserve a greater amount of interest than under Texas law). The Maximum Lawful Rate shall be calculated in a manner that takes into account any and all fees, payments, and other charges in respect of the Loan Documents that constitute interest under applicable law. Each change in any interest rate provided for herein based upon the Maximum Lawful Rate resulting from a change in the Maximum Lawful Rate shall take effect without notice to Borrowers at the time of such change in the Maximum Lawful Rate. |

| 4834-9142-1879 v.10 12 “Multiemployer Plan” means a multiemployer plan defined as such in Section 3(37) of ERISA to which contributions have been made by any Borrower or any ERISA Affiliate and which is covered by Title IV of ERISA. “Net Income” means the net income (or loss) of Borrowers and their Subsidiaries for the period in question, determined on a consolidated basis and consistent with practices as of the date hereof or otherwise in accordance with GAAP. “Notes” means, collectively, all promissory notes (and “Note” means any of such Notes) executed at any time by Borrowers and payable to the order of Lender, as amended, renewed, replaced, extended, supplemented, consolidated, restated, modified, otherwise changed and/or increased from time to time. “Obligated Party” means each Borrower, each Guarantor and any other Person who is or becomes party to any agreement that guarantees or secures payment and performance of the Obligations or any part thereof. “Obligations” means all obligations, indebtedness, and liabilities of Borrowers, each Guarantor and any other Obligated Party to Lender or any Affiliate of Lender, or both, now existing or hereafter arising, whether direct, indirect, related, unrelated, fixed, contingent, liquidated, unliquidated, joint, several, or joint and several, including, without limitation, the obligations, indebtedness, and liabilities under this Agreement, all Hedge Obligations under any Secured Hedge Agreements, the other Loan Documents, any cash management or treasury services agreements and all interest accruing thereon (whether a claim for post-filing or post-petition interest is allowed in any bankruptcy, insolvency, reorganization or similar proceeding) and all attorneys’ fees and other expenses incurred in the enforcement or collection thereof; provided, however, that any other term or provision of this Agreement or any other Loan Document to the contrary notwithstanding, the “Obligations” of any Obligated Party shall exclude, as to such Obligated Party, Excluded Hedge Obligations of such Obligated Party. “Operating Agreement Direct Digital” means the Amended and Restated Limited Liability Company Agreement of Direct Digital dated September 30, 2020. “Orange 142 Acquisition” means the acquisition by Direct Digital of all or substantially all of the issued and outstanding membership interests of Orange, via sale, transfer, conveyance, assignment, and/or contribution of such interests. “Priority Collateral” means the Collateral in which the Lender has a first priority security interest under the Security Agreement, subject to the Intercreditor Agreement. “Patriot Act” means the USA PATRIOT Act (Title III of Pub. L. 107-56 (signed into law October 26, 2001)). “PBGC” means the Pension Benefit Guaranty Corporation or any entity succeeding to all or any of its functions under ERISA. “Permitted Discretion” means a determination in good faith and in the exercise of reasonable (from the perspective of a secured asset-based lender) business judgment. “Permitted Indebtedness” means: (i) Debt to Lender arising under this Agreement or any other Loan Document; (ii) Term Loan Debt in accordance with the Intercreditor Agreement; (iii) Debt existing on the date hereof which is disclosed in Schedule 8.01; (iv) Debt of up to $200,000 outstanding at any time secured by a Lien described in clause (viii) of the defined term “Permitted Liens,” provided such Debt does |

| 4834-9142-1879 v.10 13 not exceed the cost of the equipment or intellectual property financed with such Debt; (v) amounts billed to a Borrower by its suppliers for goods delivered to or services performed for such Borrower in the ordinary course of business; (vi) reimbursement obligations in connection with trade letters of credit entered into in the ordinary course of business and, to the extent not subject to an Excluded Account, cash management services (including credit cards, debit cards and other similar instruments) that are secured by cash and issued on behalf of any Borrower or a Subsidiary thereof in an amount not to exceed $200,000 at any time outstanding; (vii) Debt secured by a Lien described in clause (xi) of the defined term “Permitted Liens”; (viii) Debt; extensions, refinancings and renewals of any items of Permitted Indebtedness; provided that the principal amount is not increased or the terms modified to impose materially more burdensome terms upon any Borrower or its Subsidiary, as the case may be; (ix) other unsecured Debt in an amount not to exceed $200,000 in the aggregate; and (x) the Huddled Masses Notes as in effect as of the date hereof. “Permitted Investment” means: (i) Investments existing as of the date hereof which are disclosed on Schedule 8.05; (ii) (a) marketable direct obligations issued or unconditionally guaranteed by the United States of America or any agency or any State thereof maturing within one year from the date of acquisition thereof currently having a rating of at least A-2 or P-2 from either Standard & Poor’s Corporation or Moody’s Investors Services, (b) commercial paper maturing no more than one year from the date of creation thereof and currently having a rating of at least A-2 or P-2 from either Standard & Poor’s Corporation or Moody’s Investors Service, (c) certificates of deposit issued by any bank with assets of at least $250,000,000 maturing no more than one year from the date of investment therein, and (d) money market accounts; (iii) repurchases of stock from current or former employees, directors, or consultants of the Borrower under the terms of applicable repurchase agreements at the original issuance price of such securities in an aggregate amount not to exceed $250,000 in any fiscal year; provided that no Event of Default has occurred, is continuing or could exist after giving effect to the repurchases; (iv) Investments (including debt obligations) received in connection with the bankruptcy or reorganization of customers or suppliers and in settlement of delinquent obligations of, and other disputes with, customers or suppliers arising in the ordinary course of Borrowers’ business; (v) Investments consisting of notes receivable of, or prepaid royalties and other credit extensions to, customers and suppliers who are not Affiliates, in the ordinary course of business; provided that this subparagraph (vi) shall not apply to Investments of any Borrower in any Subsidiary; (vi) Investments consisting of loans not involving the net transfer on a substantially contemporaneous basis of cash proceeds to employees, officers or directors relating to the purchase of capital stock or other Equity Interests of a Borrower pursuant to employee stock purchase plans or other similar agreements approved by such Borrower’s Board of Directors (or, if not a corporation, its equivalent authorizing body); (vii) Investments consisting of travel advances in the ordinary course of business; (viii) Investments in newly-formed Subsidiaries; provided that any such Subsidiary that is or is expected to become an After-Acquired Subsidiary complies with Section 7.13 hereof; and (ix) additional Investments that do not exceed $200,000 in the aggregate in any fiscal year if, at the time of such Investment and after giving effect thereto, the Borrower is in compliance with the Financial Covenants in Article IX (or, for any period prior to December 31, 2020, would be in compliance if the requirement thereunder were in effect as of the date of such Investment). “Permitted Liens” means any and all of the following: (i) Liens in favor of the Lender; (ii) Liens in favor of the Term Loan Lender securing the Debt under the Term Loan Documents, subject to the Intercreditor Agreement; (iii) Liens existing as of the date hereof which are disclosed in Schedule 8.02 hereto; (iv) Liens for taxes, fees, assessments or other governmental charges or levies, either not delinquent or being contested in good faith by appropriate proceedings; provided that Borrowers maintain adequate reserves therefor in accordance with GAAP; (v) Liens securing claims or demands of materialmen, artisans, mechanics, carriers, warehousemen, landlords and other like Persons arising in the ordinary course of any Borrower’s business and imposed without action of such parties; (vi) Liens arising from judgments, decrees or attachments in circumstances which do not constitute an Event of Default hereunder; (vii) Liens on deposits held in an Excluded Account; (viii) Liens on equipment or software or other intellectual property |

| 4834-9142-1879 v.10 14 constituting purchase money Liens and Liens in connection with capital leases securing Indebtedness permitted in clause (iv) of “Permitted Indebtedness”; (ix) Liens incurred in connection with Subordinated Debt; (x) leasehold interests in leases or subleases and licenses granted in the ordinary course of business and not interfering in any material respect with the business of the licensor; (xi) Liens in favor of customs and revenue authorities arising as a matter of law to secure payment of custom duties that are promptly paid on or before the date they become due; (xii) Liens on insurance proceeds securing the payment of financed insurance premiums that are promptly paid on or before the date they become due (provided that such Liens extend only to such insurance proceeds and not to any other property or assets); (xiii) statutory and common law rights of set-off and other similar rights as to deposits of cash and securities in favor of banks, other depository institutions and brokerage firms; (xiv) easements, zoning restrictions, rights-of-way and similar encumbrances on real property imposed by law or arising in the ordinary course of business so long as they do not materially impair the value or marketability of the related property; (xv) (A) Liens on cash securing obligations permitted under clause (vi) of the definition of Permitted Indebtedness and (B) security deposits in connection with real property leases, the combination of (A) and (B) in an aggregate amount not to exceed $300,000 at any time; (xvi) sales, transfers or other dispositions of assets permitted by Section 8.08 and, in connection therewith, customary rights and restrictions contained in agreements relating to such transactions pending the completion thereof or during the term thereof, and any option or other agreement to sell, transfer, license, sublicense, lease, sublease or dispose of an asset permitted by Section 8.08, in each case, such terms being agreed to and such transactions entered into in the ordinary course of business; and (xvii) Liens incurred in connection with the extension, renewal or refinancing of the Debt secured by Liens of the type described in clauses (i) through (xvi) above; provided that any extension, renewal or replacement Lien shall be limited to the property encumbered by the existing Lien and the principal amount of the Debt being extended, renewed or refinanced (as may have been reduced by any payment thereon) does not increase. “Permitted Tax Distributions” means, quarterly tax distributions by Direct Digital to its constituent members in the amount necessary to satisfy U.S. federal, state and local income tax obligations allocated to such members based on the taxable income of and its Subsidiaries on a consolidated basis for such taxable year, in an aggregate amount determined in accordance with the terms of the organizational documents of Direct Digital. Direct Digital may make such distributions after the end of the taxable year, or make such distributions on a quarterly basis during the taxable year to reflect estimated tax obligations of the members and their direct or indirect equityholders. For the avoidance of doubt, Permitted Tax Distributions based on estimates shall be made on a “rolling basis” and will be trued-up at least annually “Person” means any individual, corporation, limited liability company, business trust, association, company, partnership, joint venture, Governmental Authority, or other entity, and shall include such Person’s heirs, administrators, personal representatives, executors, successors and assigns. “Plan” means any employee benefit or other plan established or maintained by any Borrower or any ERISA Affiliate and which is covered by Title IV of ERISA. “Preferred Equity” means the Equity Interests issued to USDM Holdings, Inc., a Texas corporation, and other “Preferred Unit Holders” pursuant to the Operating Agreement of Direct Digital. “Preferred Equity Subordination Agreement” means that certain Preferred Equity Subordination Agreement of even date herewith, by and among Direct Digital, the holder(s) of the Preferred Equity and Lender, as amended, restated, supplemented or otherwise modified from time to time. “Prime Rate” means, for any day, the rate of interest announced from time to time by Lender as its “base” or “prime” rate of interest, which Borrowers hereby acknowledge and agree may not be the lowest |

| 4834-9142-1879 v.10 15 interest rate charged by Lender and is set by Lender in its sole discretion, changing when and as said prime rate changes. “Principal Office” means the principal office of Lender, presently located at 5001 Spring Valley Road, Suite 825W, Dallas, Texas 75224. “Prohibited Transaction” means any non-exempt transaction set forth in Section 406 of ERISA or Section 4975 of the Code. “Property” of a Person means any and all property, whether real, personal, tangible, intangible or mixed, of such Person, or any other assets owned, operated or leased by such Person. “Related Indebtedness” has the meaning set forth in Section 11.20 of this Agreement. “Release” means, as to any Person, any release, spill, emission, leaking, pumping, injection, deposit, disposal, disbursement, leaching, or migration of Hazardous Materials into the indoor or outdoor environment or into or out of property owned by such Person, including, without limitation, the movement of Hazardous Materials through or in the air, soil, surface water, ground water, or property. “Remedial Action” means all actions required to (a) clean up, remove, treat, or otherwise address Hazardous Materials in the indoor or outdoor environment, (b) prevent the Release or threat of Release or minimize the further Release of Hazardous Materials so that they do not migrate or endanger or threaten to endanger public health or welfare or the indoor or outdoor environment, or (c) perform pre-remedial studies and investigations and post-remedial monitoring and care. “Reportable Event” means any of the events set forth in Section 4043 of ERISA that requires the Borrower or Subsidiary to notify the PBGC of such event, and the reporting of which is not otherwise waived. Responsible Officer” means (a) for any Borrower, the chief executive officer, president, chief financial officer, or treasurer of such Borrower or any Person designated by a Responsible Officer to act on behalf of a Responsible Officer; provided that such designated Person may not designate any other Person to be a Responsible Officer. Any document delivered hereunder that is signed by a Responsible Officer of Borrowers shall be conclusively presumed to have been authorized by all necessary corporate, partnership and/or other action on the part of Borrowers and such Responsible Officer shall be conclusively presumed to have acted on behalf of Borrowers and (b) for each other Person, (i) in the case of a corporation, its chief executive officer, president, chief financial officer, treasurer, assistant treasurer or controller, and a secretary or assistant secretary for the purposes of delivering incumbency certificates, or as a second Responsible Officer in any case where two Responsible Officers are acting on behalf of such corporation; (ii) in the case of a limited partnership, the Responsible Officer of the general partner, acting on behalf of such general partner in its capacity as general partner; or (iii) in the case of a limited liability company, the Responsible Officer of the managing member, acting on behalf of such managing member in its capacity as managing member. “Revolving Credit Advance” means any Advance made by Lender to Borrowers pursuant to Section 2.01(a) of this Agreement. “Revolving Credit Availability” means on any date of determination the Commitment minus the aggregate amount of all outstanding Revolving Credit Advances. |

| 4834-9142-1879 v.10 16 “Revolving Credit Note” means the promissory note of Borrowers payable to the order of Lender, in substantially the form of Exhibit C hereto, and all amendments, extensions, renewals, replacements, and modifications thereof. “RICO” means the Racketeer Influenced and Corrupt Organization Act of 1970. “Sanction(s)” means any sanction administered or enforced by the United States Government (including without limitation, OFAC), the United Nations Security Council, the European Union, Her Majesty’s Treasury (“HMT”) or other relevant sanctions authority. “Secured Hedge Agreement” means any Hedge Agreement permitted under this Agreement entered into by and between any Obligated Party and any Hedge Bank. “Security Agreement” means the Security Agreement dated of even date herewith of Borrowers and the other Obligated Parties party thereto in favor of Lender, in form and substance satisfactory to Lender, as the same may be amended, restated, supplemented, modified, or changed from time to time. “Security Documents” means the Security Agreement, each Guaranty, and each and every other security agreement, pledge agreement, mortgage or other collateral security agreement required by or delivered to Lender from time to time to secure the Obligations or any portion thereof. “Specified Financial Covenants” has the meaning set forth in Section 10.04. “Specified Obligated Party” means any Obligated Party that is not an Eligible Contract Participant (determined prior to giving effect to Section 7.14 hereof or any other “keepwell, support or other agreement” (as defined in the Commodity Exchange Act), or any similar provision contained in any Guaranty). “Subordinated Debt” means any Debt of Borrowers (other than the Obligations) that has been subordinated to the Obligations by written agreement, in form and content satisfactory to Lender, including without limitation, any payment obligations on the Preferred Equity. “Subsidiary” means (a) any corporation of which at least a majority of the outstanding shares of stock having by the terms thereof ordinary voting power to elect a majority of the board of directors of such corporation (irrespective of whether or not at the time stock of any other class or classes of such corporation shall have or might have voting power by reason of the happening of any contingency) is at the time directly or indirectly owned or controlled by any Borrower or one or more of the Subsidiaries or by any Borrower and one or more of the Subsidiaries; and (b) any other entity (i) of which at least a majority of the ownership, equity or voting interest is at the time directly or indirectly owned or controlled by one or more of Borrowers and the Subsidiaries and (ii) which is treated as a subsidiary in accordance with GAAP. “Subsidiary Guarantors” means each Domestic Subsidiary of each Borrower formed or acquired after the date hereof who from time to time guarantees all or any part of the Obligations, and “Subsidiary Guarantor” means any one of the Subsidiary Guarantors. “Term Loan Debt” means the secured indebtedness of Borrowers under the Term Loan Agreement in a principal amount not to exceed Twelve Million Eight Hundred Twenty-Five Thousand Dollars ($12,825,000). |