| 4817-7159-2653 v.1 Anything herein to the contrary notwithstanding, the Liens and security interests securing the obligations evidenced by this revolving credit note, the exercise of any right or remedy with respect hereto and certain of the rights of the holder hereof are subject to the provisions of the Intercreditor Agreement, dated as of September 30, 2020 (as amended, restated, supplemented, substituted, replaced or otherwise modified from time to time, the "Intercreditor Agreement"), by and between Silverpeak Credit Partners, LP (in its capacity as agent for the Silverpeak Facility Lenders and together with its successors and assigns, the "Silverpeak Facility Agent"), for and on behalf of the Silverpeak Facility Creditors and each other Silverpeak Facility Claimholder (each as defined in the Intercreditor Agreement) from time to time, and East West Bank (“EWB”), acting on behalf of each A/R Facility Claimholder (as defined in the Intercreditor Agreement). In the event of any conflict between the terms of the Intercreditor Agreement and this revolving credit note, the terms of the Intercreditor Agreement shall govern and control. REVOLVING CREDIT NOTE $4,500,000 September 30, 2020 FOR VALUE RECEIVED, Direct Digital Holdings, LLC, a Texas limited liability company (“Direct Digital”), Colossus Media, LLC, a Delaware limited liability company (“Colossus”), Huddled Masses LLC, a Delaware limited liability company (“HM”), Orange142, LLC, a Delaware limited liability company (“Orange”) and Universal Standards for Digital Marketing, LLC, a Delaware limited liability company (“USDM” and together with Direct Digital, Colossus, HM, and Orange, collectively, “Borrower”), hereby unconditionally, jointly and severally, promise to pay to the order of EAST WEST BANK, a California state bank (“Lender”), in accordance with the provisions of the Credit Agreement (as hereinafter defined), the principal sum of Four Million Five Hundred Thousand Dollars ($4,500,000), or such other amount as may from time to time be advanced by Lender as Revolving Credit Advance to or for the benefit or account of Borrower pursuant to the terms of that certain Credit Agreement, dated as of the date hereof (as amended, restated, extended, supplemented or otherwise modified in writing from time to time, the “Credit Agreement;” the terms defined therein being used herein as therein defined), between Borrower and Lender. Borrower promises to pay interest on the unpaid principal amount of this Note from the date hereof until the Revolving Credit Advances made by Lender are paid in full, at such interest rates and at such times as provided in the Credit Agreement. All payments of principal and interest shall be made to Lender in Dollars in immediately available funds at Lender’s Principal Office. If any amount is not paid in full when due hereunder, then such unpaid amount shall bear interest, to be paid upon demand, from the due date thereof until the date of actual payment (and before as well as after judgment) computed at the per annum rate set forth in the Credit Agreement. This Note is the Revolving Credit Note referred to in the Credit Agreement, is entitled to the benefits thereof and may be prepaid in whole or in part subject to the terms and conditions provided therein. This Note is also entitled to the benefits of the Guaranty. Upon the occurrence and continuation of one or more of the Events of Default specified in the Credit Agreement, all amounts then remaining unpaid on this Note shall become, or may be declared to be, immediately due and payable all as provided in the Credit Agreement. Lender may also attach schedules to this Note and endorse thereon the date, amount and maturity of its Revolving Credit Advances and payments with respect thereto. Borrower, for itself, its successors and assigns, hereby waives diligence, presentment, protest and demand and notice of protest, demand, dishonor and non-payment of this Note. |

| 4817-7159-2653 v.1 THIS NOTE, AND ANY CLAIM, CONTROVERSY, OR DISPUTE ARISING OUT OF OR IN CONNECTION WITH THIS NOTE, SHALL BE GOVERNED BY AND CONSTRUED IN ACCORDANCE WITH THE LAWS OF THE STATE OF TEXAS. [Remainder of Page Intentionally Left Blank; Signature Page Follows.] |

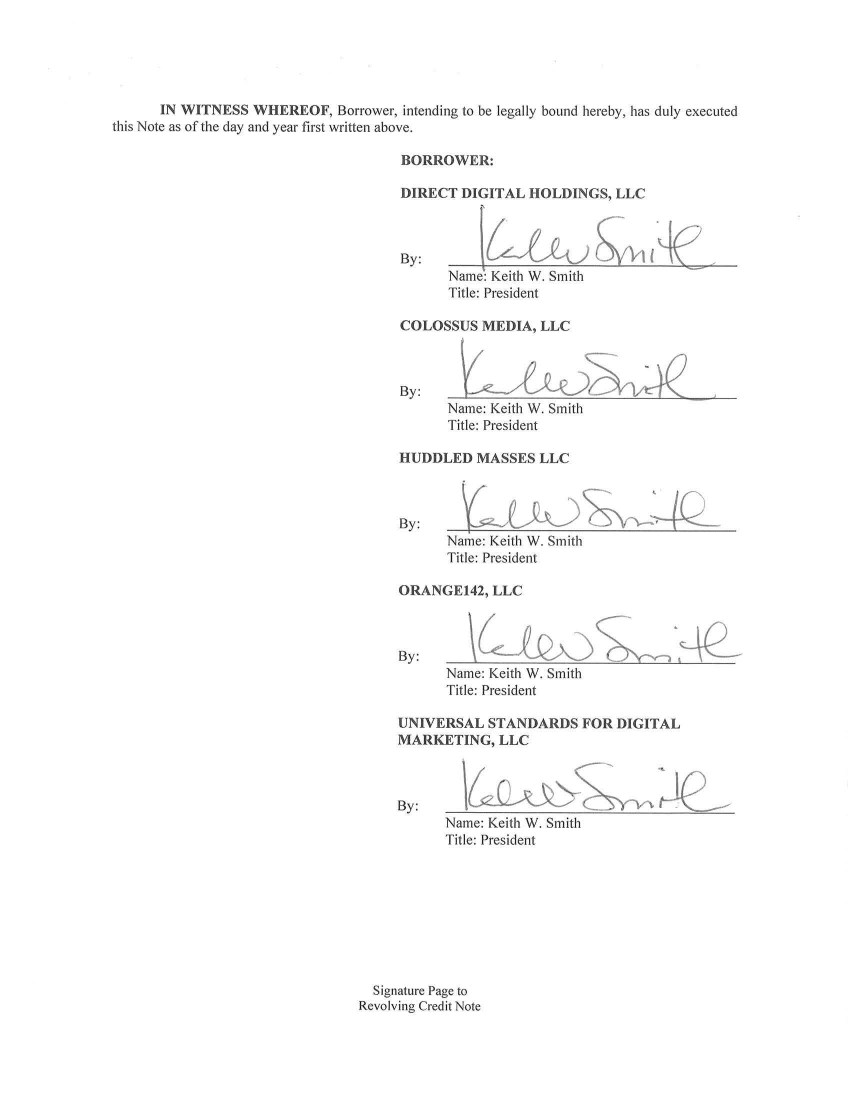

| IN WITNESS WHEREOF, Borrower, intending to be legally bound hereby, has duly executed this Note as of the day and year first written above. BORROWER: DIRECT DIGITAL HOLDINGS, LLC By: [LJA;~de, Name: Keith W. Smith Title: President COLOSSUS MEDIA, LLC By: Lau~ Name: Keith W. Smith Title: President HUDDLED MASSES LLC By: WN~~ Name: Keith W. Smith Title: President ORANGE142, LLC By: Name: Keith W. Smith Title: President UNIVERSAL STANDARDS FOR DIGITAL MARKETING, LLC By: Name: Keith W. Smith Title: President Signature Page to Revolving Credit Note |