|

Prospectus Supplement No. 1 (to Prospectus dated February 10, 2022) |

Filed Pursuant to Rule 424(b)(3) Registration Statement No. 333-261059 |

2,800,000 Units Consisting of Shares of Class A

Common Stock and Warrants

This prospectus supplement updates and supplements the prospectus dated February 10, 2022 (the “Prospectus”), which forms a part of our Registration Statement on Form S-1. This prospectus supplement is being filed to update and supplement the information in the Prospectus with the information contained in our Annual Report on Form 10-K filed with the Securities and Exchange Commission on March 31, 2022 (the “Annual Report”). Accordingly, we have attached the Annual Report to this prospectus supplement.

The Prospectus and this prospectus supplement relate to the offer and sale by us of up to (i) 3,220,000 shares of our Class A common stock, par value $0.001 per share (“Class A common stock”), that may be issued upon the exercise of warrants issued on the closing date of our initial public offering to purchase shares of Class A common stock, (ii) 161,000 warrants to purchase shares of our Class A common stock (“Additional Warrants”) that may be issued upon exercise of unit purchase options issued to the underwriters of our initial public offering and (iii) 161,000 shares of our Class A common stock that may be issued upon exercise of the Additional Warrants.

This prospectus supplement should be read in conjunction with the Prospectus and is not complete without, and may not be delivered or utilized except in combination with, the Prospectus, including any amendments or supplements thereto, which is to be delivered with this prospectus supplement. This prospectus supplement updates and supplements the information in the Prospectus. If there is any inconsistency between the information in the Prospectus and this prospectus supplement, you should rely on the information in this prospectus supplement.

Our common stock and public warrants are traded on the Nasdaq Capital Market under the symbols “DRCT” and “DRCTW,” respectively. On March 31, 2022, the last reported sale prices of our common stock and warrants on the Nasdaq Capital Market were $4.14 and $0.85, respectively.

We are an “emerging growth company,” as defined under the Securities Act of 1933, as amended, and will be subject to reduced public reporting requirements. This prospectus supplement (including the Prospectus) complies with the requirements that apply to an issuer that is an emerging growth company.

Investing in our securities involves risks. You should review carefully the risks and uncertainties described under the heading “Risk Factors” beginning on page 25 of the Prospectus and beginning on page 14 of the Annual Report, and under similar headings in any further amendments or supplements to the Prospectus before you decide whether to invest in our securities.

Neither the Securities and Exchange Commission nor any other regulatory body or state securities commission has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus supplement is March 31, 2022.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR THE FISCAL YEAR ENDED DECEMBER 31, 2021

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR THE TRANSITION PERIOD FROM TO __________

COMMISSION FILE NUMBER 001-41261

DIRECT DIGITAL HOLDINGS, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 83-0662116 | |

|

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) | |

| 1233 West Loop South, Suite 1170 | ||

| Houston, Texas | 77027 | |

| (Address of principal executive offices) | (Zip code) | |

(832) 402-1051

(Registrant’s telephone number, including area code)

| Securities registered pursuant to Section 12(b) of the Act: | ||

| Title of Each Class: | Trading symbol(s) | Name of Each Exchange on Which Registered: |

| Common Stock, par value $0.001 per share | DRCT | NASDAQ |

| Warrants to Purchase Common Stock | DRCTW | NASDAQ |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and "emerging growth company" in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||

| Non-accelerated filer | x | Smaller reporting company | x | |||

| Emerging growth company | x | |||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

As of June 30, 2021, the last business day of the registrant’s most recently completed second fiscal quarter, the registrant did not have a public float because the registrant’s ordinary shares were not publicly traded. Accordingly, there was no market value for the registrant’s common stock on such date.

As of March 25, 2022, there were 2,800,000 shares of the registrant’s Class A common stock outstanding, par value $0.001 per share, and 11,378,000 shares of the registrant’s Class B common stock outstanding, par value $0.001 per share.

TABLE OF CONTENTS

CERTAIN DEFINITIONS

Unless the context requires otherwise, references in this Annual Report on Form 10-K to:

| • | the “Company,” “Direct Digital,” “Direct Digital Holdings,” “DDH,” “we,” “us” and “our” refer to Direct Digital Holdings, Inc., and, unless otherwise stated, all of its subsidiaries, including Direct Digital Holdings, LLC, which we refer to as “DDH LLC,” and, unless otherwise stated, its subsidiaries. |

| • | “Colossus Media” refers to Colossus Media, LLC, the sell-side marketing platform of our business acquired in 2018, operating under the trademarked banner of Colossus SSP™. |

| • | “DDH LLC” refers to Direct Digital Holdings LLC, a Texas limited liability company jointly owned by the Company and DDM. |

| • | “DDM” refers to Direct Digital Management, LLC, a Delaware limited liability company indirectly owned by Mark Walker, our Chairman and Chief Executive Officer, and Keith Smith, our President, which entity owns LLC Units (as defined below) and which also holds noneconomic shares of Class B common stock. DDM may exchange or redeem its LLC Units for shares of our Class A common stock as described in Item 13 “Certain Relationships and Related Person Transactions, and Director Independence — DDH LLC Agreement,” together with a cancellation of the same number of its shares of Class B common stock. |

| • | “Huddled Masses” refers to Huddled Masses, LLC, the buy-side marketing platform of our business, acquired in 2018. |

| • | “LLC Units” refers to (i) economic nonvoting units in DDH LLC held by us and DDM and (ii) noneconomic voting units in DDH LLC, 100% of which are held by us. |

| • | “Orange142” refers to Orange142, LLC, the buy-side advertising platform acquired in 2020. |

| • | “Tax Receivable Agreement” refers to the tax receivable agreement by and among Direct Digital Holdings, DDH LLC and DDM, See Item 13 “Certain Relationships and Related Person Transactions, and Director Independence — Tax Receivable Agreement” for additional information. |

| • | “USDM” refers to USDM Holdings, LLC, a holding company owned by Leah Woolford, former manager of DDH LLC, which (i) following the completion of our initial public offering and related transactions on February 15, 2022, holds no LLC Units, no shares of our Class A common stock and no shares of our Class B common stock and (ii) prior to the completion of our initial public offering and related transactions on February 15, 2022, held certain units in DDH LLC. |

4

| ITEM 1. | Business |

Company Overview

We are an end-to-end, full-service programmatic advertising platform primarily focused on providing advertising technology, data-driven campaign optimization and other solutions to underserved and less efficient markets on both the buy- and sell-side of the digital advertising ecosystem. Direct Digital Holdings, Inc., incorporated as a Delaware corporation on August 23, 2021, is the holding company for DDH LLC, the business formed by our founders in 2018 through the acquisitions of Huddled Masses and Colossus Media. Colossus Media operates our proprietary sell-side programmatic platform operating under the trademarked banner of Colossus SSP™. Huddled Masses is the platform for the buy-side of our business. In 2020 we acquired Orange142 to further bolster our overall programmatic buy-side advertising platform and enhance our offerings across multiple industry verticals such as travel, healthcare, education, financial services and consumer products with particular emphasis on small and mid-sized businesses transitioning into digital with growing digital media budgets. In February 2022, we completed our initial public offering and certain organizational transactions which resulted in our current structure.

In the digital advertising space, buyers, particularly small and mid-sized businesses, can potentially achieve significantly higher return on investment (“ROI”) on their advertising spend compared to traditional media advertising by leveraging data-driven over-the-top/connected TV (“OTT/CTV”), video and display, in-app, native and audio advertisements that are delivered both at scale and on a highly targeted basis. Traditional (non-digital) advertising, such as broadcast TV or print media, follows the “spray and pray” approach to reach out to the public, but the ROI from using such traditional (non-digital) advertising campaigns is mostly unpredictable. On the other hand, digital advertising is heavily data-driven and can provide real-time details of targeted advertising campaigns and outcomes. On the sell-side, publishers can more successfully sell their advertising inventory in a programmatic manner by sharing data and information about their digital audiences at scale on an individualized basis, which helps buyers to better target audiences.

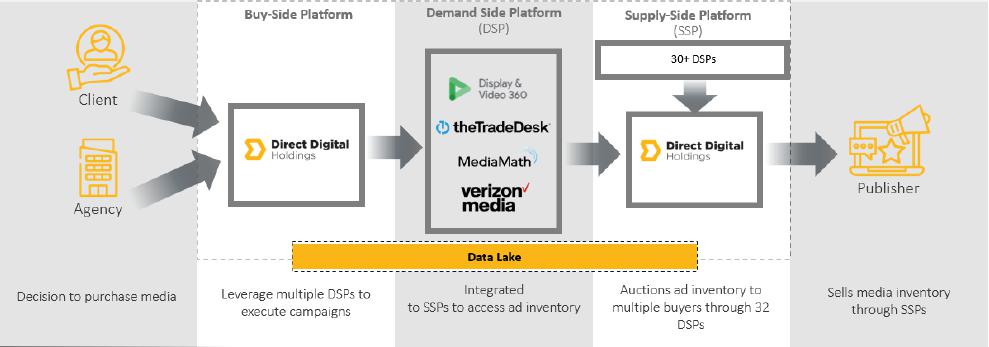

Programmatic Marketplace Transaction

The Buy Side

On the buy side of the digital supply chain, digital advertising is the practice of delivering promotional content to users through various online and digital channels and leverages multiple channels, platforms such as social media, email, search engines, mobile applications and websites to display advertisements and messages to audiences. Traditional (non-digital) advertising follows the “spray and pray” approach to reach out to the public, but the ROI is mostly unpredictable. On the other hand, digital advertising is heavily data-driven and can give real-time details of advertising campaigns and outcomes. The availability of user data and rich targeting capabilities makes digital advertising an effective and important tool for businesses to connect with their audiences.

We have aligned our business strategy to capitalize on significant growth opportunities due to fundamental market shifts and industry inefficiencies. Several trends, happening in parallel, are revolutionizing the way that advertising is bought and sold. Specifically, the rise of the internet has led to a wholesale change in the way that media is consumed and monetized, as ads can be digitally delivered on a 1-to-1 basis. In traditional methods of advertising, such as broadcast TV, ads can target a specific network, program, or geography, but not a single household or individual as digital and OTT/CTV ads can. Additionally, we expect that the continued destabilization, including the phase out of digital “cookies” in 2023, will (i) create more opportunities for technology companies that provide next-generation CTV and digital solutions and (ii) minimize performance disruption for advertisers and agencies.

5

The Buy-Side Business: Huddled Masses & Orange142

The buy-side segment of our business, operated through Huddled Masses, which has been in operation since 2012, and Orange142, which has been in operation since 2013, enables us to provide the programmatic purchase of advertising on behalf of our clients. Programmatic advertising is rapidly taking market share from traditional ad sales channels, which require more staffing, offer less transparency and involve higher costs to buyers. Our buy-side platform provides the technology for first-party data management, media purchases, campaign execution and analytics, and therefore helps drive increased ROI across a wide array of digital media channels. Because our technology accesses several of the large demand side platforms (“DSPs”), our platform is able to leverage customer insights across multiple DSPs to drive campaign performance and ROI for our clients. By taking this DSP-agnostic approach, our platform provides the broadest market access for our clients so that clients can easily buy ads on desktop, mobile, connected TV, linear TV, streaming audio and digital billboards. Additionally, our technology has unique visibility across inventory to create customized audience segments at scale. Depending on the client objective and DSP we choose, our buy-side platform provides forecasting and deep market insights to our clients to improve their return-on-advertising spend (“ROAS”) across channels.

The buy-side segment businesses offer technology-enabled advertising solutions and strategic planning to clients. In particular, our buy-side platform focuses on small to-mid-sized clients and enable them to leverage programmatic technology to engage their potential customers more directly, on a one-on-one basis, in any local market, with specificity to media device and footprint. Our technology leverages data to assess where our clients’ potential customers are in the decision-making process and manage campaign pacing and optimization based on data-driven analytics to drive the purchasing decision or encourage the call to action. With marketing budgets typically more limited and operating footprints generally more local or state-to-state, we believe small and mid-sized businesses are focused primarily on ROI-based results that deliver precise advertising and measurable campaign success to level the playing field with larger competitors. Serving the needs of approximately 200 small and mid-sized clients for the fiscal year ended December 31, 2021, the buy-side of our business leverages the insights of leading DSPs, such as The Trade Desk, Xandr, Google DV360, MediaMath and others, to drive increased advertising ROI and reduced customer acquisition costs for our clients. The result is the benefit to our buy-side clients in that they enjoy a more even playing field compared to larger advertisers by driving more effective marketing and advertising in local markets that are compatible to their business footprint.

We believe that we have a unique competitive advantage due to our data-driven technology that allows us to provide front-end, buy-side planning for our small and mid-sized clients, coupled with our proprietary Colossus SSP where we can curate the last-mile in the execution process to drive higher ROI. In our business and throughout this Annual Report on Form 10-K, we use the terms client and customer interchangeably.

The Sell Side

On the sell side of the digital supply chain, the supply side platform (“SSP”), is an ad technology platform used by publishers to sell, manage and optimize the ad inventory on their websites in an automated and effective way. The SSPs help the publishers monetize the display ads, video ads, and native ads on their websites and mobile apps. The SSPs have enhanced their functionalities over the years and have included ad exchange mechanisms to efficiently manage their ad inventory. Also, SSPs allow the publishers to connect to DSPs directly instead of connecting through ad exchanges. The SSP allows publishers’ inventory to be opened up and made available to advertisers they may not be able to directly connect with. SSPs sell ad inventories in many ways — for example, directly to ad networks, via direct deals with DSPs, and most commonly via real-time bidding (“RTB”) auctions. The publisher makes its ad inventory available on an SSP and invites advertisers to bid based on the user’s data received. Each time the publisher’s web page loads, an ad request is sent to multiple ad exchanges and, in some cases, to the demand side platform directly from the SSP. In the case of RTB media buys, many DSPs would place bids to the impressions being offered by the publisher during the auction. The advertiser that bids a higher amount compared to other advertisers will win the bid and pay the second highest price for the winning impression to serve the ads.

6

The Sell-Side Platform: Colossus SSP

Colossus Media, which has been in operation since 2017, is our proprietary sell-side programmatic platform operating under the trademarked banner of Colossus SSP™. Our sell-side segment maintains a proprietary platform, Colossus SSP, which is an advertising technology platform used by publishers to manage, sell and optimize available inventory (ad space) on their websites and mobile apps in an automated way. In December 2021, our platform processed over 70 billion impressions, over 200 billion auction bid requests that seek to buy ad inventory from our publishers and served approximately 80,000 buyers. Each impression or transaction occurs in a fraction of a second. Given that most transactions take place in an auction/bidding format, we continue to make investment across the platform to further reduce the processing time. In addition to the robust infrastructure supporting our platform, it is also critical that we align with key industry partners in the digital supply chain.

Colossus SSP is agnostic to any specific demand side platform. To that end, our proprietary Colossus SSP is integrated into several leading DSPs both directly, through Bidswitch, and indirectly, through such platforms as Xandr/AppNexus, The Trade Desk, Google 360, Verizon Media, MediaMath, Zeta Global, Samsung, Pulsepoint, and others. We continue to add new DSP partners especially where we believe the DSP might offer a unique advertising base seeking to target our multicultural audiences at scale. We help our advertiser clients efficiently reach diverse communities including African Americans, Latin Americans, Asian Americans and LGBTQ+ customers in highly targeted campaigns. This business began as a trading desk supporting advertisers’ desires to reach diverse audiences and has evolved into the preeminent ad tech platform to support this goal. We partner with both large publishers such as Hearst, MediaVine, Gannett, and several others, as well as smaller publishers such as Ebony Magazine, People Magazine, Newsweek, Blavity, La Nacion and many others.

Colossus SSP offers our publisher clients’ ad inventory to existing small and mid-sized buy-side clients at Huddled Masses and Orange142, and other major DSP clients of Colossus Media, which enables our buy-side technology to curate and manage client outcomes more effectively. In addition, because it is a stand-alone platform, Colossus SSP offers its ad inventory to larger, multinational, clients seeking more authentic advertising access to unique, often diverse and multicultural, audiences.

Our proprietary Colossus SSP was custom developed with a view towards the specific challenges facing small and mid-sized publishers with the belief that often smaller publishers offer a more engaged, highly-valued, unique following but experienced technological and budgetary constraints on the path to monetization. Connecting our buy-side business to Colossus SSP completes the end-to-end solution for our small to-mid-sized buy-side customers while creating additional revenue opportunities for our Colossus SSP publishers.

Our business strategy on the sell-side also presents significant growth potential, as we believe we are well positioned to be able to bring underserved multicultural publishers into the advertising ecosystem, thereby increasing our value proposition across all clients including our large clients. We have proprietary rights to the Colossus SSP via a license agreement with a third-party developer. We believe the Colossus SSP is the last-mile of delivery for our buy-side clients in that our technology curates unique, highly optimized audiences informed by data analytics, artificial intelligence and algorithmic machine-learning technology, resulting in increased campaign performance.

The Data Management Platform

We also leverage a sophisticated data management platform, which is DDH’s proprietary data collection and data marketing platform used to gather first-party data, market intelligence and audience segmentation information to support campaign optimization efforts for buy-side clients, Colossus SSP clients and third-party clients. Our combined platform offers results in an enhanced, highly loyal client base, particularly on the buy-side.

Our Industry and Trends

There are several key industry trends that are revolutionizing the way that advertising is bought and sold. We believe that we are well positioned to take advantage of the rapidly evolving industry trends in digital marketing and shifts in consumer behavior, including:

Shift to Digital Advertising. Media has increasingly become more digital as a result of three key items:

| • | Advances in technology with more sophisticated digital content delivery across multiple platforms; |

| • | Changes in consumer behavior, including spending longer portions of the day using mobile and other devices; and |

| • | Better audience segmentation with more efficient targeting and measurable results. |

The resulting shift has enabled a variety of options for advertisers to efficiently target and measure their advertising campaigns across nearly every media channel and device. These efforts have been led by big-budgeted, large, multi-national corporations incentivized to cast a broad advertising net to support national brands.

7

Shift from Linear Broadcast to OTT/CTV. According to eMarketer, as of the end of 2022, approximately 68.5 million U.S. households will maintain a cable subscription which declined from approximately 78 million U.S. households at the end of 2020. However, advertising reach could access more than 240.7 million households via OTT subscriptions, or at least 70 million households via ad-supported OTT/CTV channels, according to ComScore’s “State of OTT 2021” report. Consumers increasingly want the flexibility and freedom to consume content on their own terms resulting in access to premium content at lower prices and with fewer interruptions. Advertisers are recognizing these trends and reallocating their ad budgets accordingly to those companies that can access audiences through a variety of existing and new channels.

Increased Adoption of Digital Advertising by Small and Mid-Sized Companies. Only recently small and mid-sized businesses have begun to leverage the power of digital media in meaningful ways, as emerging technologies have enabled advertising across multiple channels in a highly localized nature. Campaign efficiencies yielding measurable results and higher advertising ROI, as well as the needs necessitated by the global Coronavirus Disease 2019 (“COVID-19”) pandemic, have prompted these companies to begin utilizing digital advertising on an accelerated pace. We believe this market is rapidly expanding, and that small to-mid-sized advertisers will continue to increase their digital spend.

Significant Increase in Multicultural Audience and Targeted Content. As digital media has grown and emerging marketing channels continue to gain adoption, audience segmentation, including on multicultural lines, has become more granular. A growing and increasing segment of those audiences is the multicultural audience, which has been traditionally underserved in the industry. According to the U.S. Census Bureau, racial minority and multi-racial consumers represent 42% of the U.S. population and are projected to be the numerical majority in the U.S. by 2044. When we expand the definition of multicultural to include LGBTQ+ customers, the numbers are significantly greater. Advertisers and publishers alike face the same challenge. Advertisers are seeking new avenues and opportunities to connect with multicultural audiences in their natural media consumption environments while publishers are producing unique content to attract loyal consumers. The advantage will go to those innovative companies able to directly connect both sides to those audiences and leverage the insights flowing from those connections.

Local Ad Buying Becoming More Programmatic. Programmatic advertising enables advertisers to precisely target local audiences and increasingly an “audience of one.” Large amounts of inventory have been consolidated, allowing local advertisers to then be more selective about where, when and to whom they show their ads. The technology behind programmatic advertising, such as geotargeting, IP address identification, 1-3-5 radius store location advertising, has provided the opportunity for targeted local advertising to smaller advertisers, which technologies in the past have been more easily available to larger national advertisers. We believe being able to go into a programmatic platform and target the same audience across all digital inventory is a major competitive advantage. Additionally, we also believe that the ability to customize audiences to the needs of local providers is a significant benefit for local advertisers since they are able to deviate from the broad audience segments defined by national advertisers. Higher customer engagement translates into higher retention and extended customer lifecycle representing the opportunity to sell and upsell customers. We believe the local advertising market remains in the early stages of understanding and leveraging these capabilities.

Death of Cookies Will Likely Destabilize Small-to-Mid-Size Business Ad Market. As the advertising industry faces the eventual phasing out of third-party cookies, namely by Google, by 2023, small-to-mid-sized business will face potentially greater challenges in the adoption and transition to digital. While first- party data driven by first-party cookies will still have broad-based advertising support, more robust advertising efforts are expected to experience some level of performance degradation. Specifically, the inability to tie ad impressions to an identity will add to the list of challenges already being faced by small-to-mid-sized businesses. We expect that the destabilization will create significant opportunities for next-generation technology companies that can provide media buying solutions and minimize performance disruption for advertisers and agencies.

The COVID-19 pandemic has put a greater focus on ROI on ad spend performance. Compared to traditional channels, digital ads are more measurable and flexible, which makes them more attractive and resilient.

Our Customers

On the buy-side of our business, our customers consist primarily of purchasers of digital advertising inventory and consulting services. We served the needs of approximately 200 small and mid-sized clients during the fiscal year ended December 31, 2021, consisting of advertising buyers, including small and mid-sized companies, large advertising holding companies (which may manage several agencies), independent advertising agencies and mid-market advertising service organizations. Many advertising agencies and advertising holding companies have decision-making that is generally highly decentralized, such that purchasing decisions are made, and relationships with advertisers are located, at the agency, local branch or division level. We serve a variety of customers across multiple industries including travel/tourism (including destination marketing organizations or DMOs), energy, consumer packaged goods (“CPG”) healthcare, education, financial services (including cryptocurrency technologies) and other industries. Some of the significant brands we work with on the buy-side include the U.S. Army, Just Energy, Bitcoin Depot, Visit Virginia Beach, Visit Colorado Springs and Pigeon Forge.

8

On the sell-side of our business, the Colossus SSP, the buyers on our platform include DSPs, agencies and individual advertisers. We have broad exposure to the ecosystem of buyers, reaching on average approximately 15,400 advertisers per month in 2020, which has increased to approximately 80,000 in December 2021. As spending on programmatic advertising increasingly becomes a larger share of the overall ad spend, advertisers and agencies are seeking greater control of their digital advertising supply chains. To take advantage of this industry shift, we have entered into Supply Path Optimization (“SPO”) agreements directly with buyers. As part of these agreements, we are providing advertisers and agencies with benefits ranging from custom data and workflow integrations, product features, volume-based business terms, and visibility into campaign performance data and methodology. As a result of these direct relationships, our existing advertisers and agencies are incentivized to allocate an increasing percentage of their advertising budgets to our platform.

Our Competitive Strengths

We believe the following attributes and capabilities form our core strengths and provide us with competitive advantages:

| • | End-to-End, Technology-Driven Solution Focused on Providing Higher Value to Underserved Markets. Our small and mid-sized client base is seeking high ROI, low customer acquisition costs and measurable results that grow their topline. Because we focus exclusively on the first and last miles of media delivery, we engage clients at the front-end of the digital supply chain with the first dollar of spend, in many cases prior to agency involvement, and drive data-driven results across the digital advertising ecosystem to optimize ROI. We offer an end-to-end solution that enables us to set and carry- out the digital campaign strategy of our clients in full, in a more efficient and less expensive manner than some of our competitors. Small and mid-sized companies are looking for partners that can drive results across the entire digital supply chain. On the Colossus SSP, we offer a wide range of niche and general market publishers an opportunity to maximize advertising revenue driven by technology-enabled targeted advertising to multicultural and other audiences. We believe our technology’s ability to tailor our efforts to our clients-specific needs and inform those efforts with data and algorithmic learnings is a long-term advantage to serving this end of the market. |

| • | Comprehensive Processes Enhance Ad Inventory Quality and Reduce Invalid Traffic (“IVT”). We operate what we believe to be one of the most comprehensive processes in the digital advertising ecosystem to enhance ad inventory quality. In January 2022, Colossus SSP was ranked by MediaMath as 5th among the industry’s approximately 80 supply-side companies in terms of key quality measures such as transparency, fraud detection, and accountability. In the advertising industry, inventory quality is assessed in terms of IVT, which can be impacted by fraud such as “fake eyeballs” generated by automated technologies set up to artificially inflate impression counts. As a result of our platform design and proactive IVT mitigation efforts, in 2021, less than 1% of inventory was determined to be invalid, resulting in minimal financial impact to our customers. We address IVT on a number of fronts, including: sophisticated technology, which detects and avoids invalid traffic on the front end; direct publisher and inventory relationships, for supply path optimization; and ongoing campaign and inventory performance review, to ensure inventory quality and brand protection controls are in place. |

| • | Curated Data-Driven Sell-Side Platform to Support Buy-Side. The Colossus SSP enables us to gather data to build and develop unique product offerings for our clients. The ability to curate our supply allows us to serve a broad range of clients with challenging and unique advertising needs and optimize campaign performance in a way that our siloed competitors are unable to do. This model, together with our infrastructure solutions and ability to quickly access excess server capacity, helps us scale up efficiently and allows us to grow our business at a faster pace than a pure buy-side solution would. In addition, our clients can easily buy targeted data from over 150 sources through our platform. We also provide clients access to our proprietary data through our data management platform, which only increases with continued use of our platform. We believe that the integration of data and decisioning within a single platform enables us to better serve our clients. |

9

| • | High Client Retention Rate and Cross Selling Opportunities. During the fiscal year ended December 31, 2021, we had approximately 200 clients on the buy-side and 80,000 clients on the sell-side. They understand the independent nature of our platform and relentless focus on driving ROI-based results. Our value proposition is complete alignment across our entire digital supply platform beginning with the first dollar in and last dollar out. We are technology and media agnostic, and our clients trust us to provide the best opportunity for success of their brands and businesses. As a result, our clients have been loyal, with over 90% client retention for the clients that represent approximately 80% of our revenues for the fiscal years ended December 31, 2021 and 2020. In addition, we cultivate client relationships through our pipeline of moderate and self-serve clients that conduct campaigns within our platform that eventually grow into managed service clients, which has resulted in their increased use of our platform over time. As our clients expand their usage of our technology platform, they often transition to our managed services delivery model, which in turn drives increased client loyalty. The managed services delivery model allows us to combine our technology with a highly personalized offering to strategically design and manage advertising campaigns, provide ad hoc support and recommend strategy adjustments as needed. |

| • | Growing and Profitable Business Model. We have grown our revenue steadily while increasing our gross profit, which we believe demonstrates the power of our technology platform, the strength of our client relationships and the leverage inherent to our business model. On September 30, 2020, we acquired Orange142 to further bolster our overall buy-side advertising platform and enhance our offerings across multiple industry verticals such as travel, healthcare, education, financial services, consumer products and others, with particular emphasis on small and mid-sized businesses transitioning into digital with growing digital media budgets. For the years ended December 31, 2021 and 2020, our net loss was $(1.5) million and $(0.9) million, respectively, and Adjusted EBITDA, a non-GAAP financial measure, for the years ended December 31, 2021 and 2020 was $6.4 million and $0.6 million, respectively. Please see the section of this Annual Report titled “Management’s Discussion and Analysis of Financial Condition and Results of Operations – Non-GAAP Financial Measures” for a reconciliation of non-GAAP financial measures to the most directly comparable measures calculated in accordance with GAAP. |

| • | Solutions for the Destabilization of Advertising. As a result of the impending phase out of third-party cookies by 2023 by Google, we have begun integrating identity resolution solutions in order to provide our clients with accurate, targeted advertising without cookies. We believe these solutions provide higher CPM (cost per thousand impressions) advertising, thus resulting in higher revenues. Leveraging our third-party technology providers, our technology has a potential reach of over 250 million matched people online and is powered by over 600 million unique online authentication events per month. To cater to the need for precision and scale, we will be investing in artificial intelligence and machine learning technology to build out our own collection of identities, often referred to as an “ID Lake,” from first-party and third-party data sources, that will facilitate matches and relations between the disparate sets of data. |

| • | Experienced Management Team. Our management team, led by our two founders, has significant experience in the digital advertising industry and with identifying and integrating acquired businesses. Specifically, our two founders, Chairman and Chief Executive Officer Mark Walker and President Keith Smith, have over 45 years of combined experience. The team has led digital marketing efforts for companies both large and small, with unique experience leading small and mid-sized companies through the challenges of transitioning platforms into the programmatic advertising space. Our Chief Technology Officer, Anu Pillai, is experienced in developing digital platforms on both the buy-side and sell-side, ranging from consumer-packaged goods (“CPG”) companies focused on e-commerce to publishers seeking to monetize their ad inventory. Our Chief Financial Officer, Susan Echard, a former senior auditor at Ernst & Young LLP, has significant experience working with public companies directly as well a strong background with mergers and acquisitions. |

| • | ESG-Centered Strategy. We believe our business strategy promotes the ideals of a business focused on environmental, social and governance (“ESG”) issues, with particular focus on social and governance issues. Our unique focus has already resulted in numerous partnerships with both large and small advertisers as the multicultural market continues to grow and expand. |

Social, Diversity and Governance

We believe it is essential for our organization, from top to bottom, to understand and relate to the issues our clients face on both the buy-side and sell-side. Our founding owners are of African-American descent and founded our Company on multicultural principles designed to alleviate the challenges that buyers and publishers face accessing an expansive multicultural market. Our management team reflects the tone and tenor of our multicultural audiences and our policies on gender equality and gender pay. More than 70% of our management are women and/or identify as being from a diverse background, including all four of our executive officers.

10

Environmental

Our platform requires significant amounts of information to be stored across multiple servers and we anticipate those amounts to increase significantly as we grow. We are committed to ensuring that we incorporate environmental excellence in our business mindset. Energy use, recycling practices and resource conservation are a few of the factors we take into consideration in building our technological infrastructure, selecting IT partners, and utilizing key suppliers. In the first half of 2022, we expect to transition our server platform to HPE Greenlake, which is centered on environmentally-friendly operations and marketed as “Greenlake-as-a-service,” through which we promote its energy conservation principles. We opted for HPE GreenLake’s as-a-service model because it represents a shift towards supplier responsibility for the elimination of wasted infrastructure and processing capacity. Our needs are metered and monitored, providing insights that can lead to significant resource and energy efficiencies by avoiding overprovisioning and optimizing the IT refresh cycle. This enables us to bring existing equipment to the highest levels of utilization and to eliminate idling equipment that drains energy and resources, yielding both environmental and financial savings.

Our Growth Strategy

We have a multi-pronged growth strategy designed to continue to build upon the momentum we have generated so far in order to create opportunities. Our key growth strategies include our plans to:

| • | Continue to expand our highly productive “on the ground” buy-side and sell-side sales teams throughout the United States, with a particular focus on markets where we believe our client base is underserved. |

| • | Utilize management’s experience to identify and close additional acquisition opportunities to accelerate expansion into new industry verticals, grow market share and enhance platform innovation capabilities. |

| • | Leveraging our end-to-end product offering as a differentiating factor to win new business and cross- sell to existing clients. |

| • | Aggressively grow the Colossus SSP advertising inventory, including both multicultural and general inventory. We aim to increase our omni-channel capabilities to focus on highest growth content formats such as OTT/CTV audio (such as podcasts, etc.), in-app and others. |

| • | Continued innovation and development of our data management platform and proprietary ID Lake and collection of first-party data to inform decision-making and optimize client campaigns. |

| • | Invest in further optimization of our infrastructure and technology solutions to maximize revenue and operating efficiencies. |

Revenues

We generate revenues through a broad range of offerings throughout our technology platforms. On the buy-side of our business, our technology drives the design and execution of advertising strategies across an array of digital channels including programmatic display, social, paid search, mobile, native, email, video advertising, OTT/CTV, audio, digital out-of-home (“DOOH”) and more. In the world’s constantly shifting and expanding digital landscape, where it is easy for “set it and leave it” mentalities and impersonal algorithms to steer digital advertising campaigns, our data-driven technologies enable customized ROI-focused outcomes for our clients. Our team is made up of savvy digital strategists, skilled software developers, experienced ad buyers or traders, expert technicians and data analysts. We have a wide variety of small and mid-sized companies representing numerous industry verticals such as travel, healthcare, education, financial services, and consumer goods and services. We are typically engaged on an “insertion order” or master services agreement, with the typical engagement driven by the campaign goals of the client. For our mid- sized clients, we typically engage on a long-term contractual basis ranging from one to five years, while our smaller clients tend to engage on a shorter duration of less than one year despite the fact that many of our smaller clients have been long term clients well in excess of one year.

On the sell-side of our business, through our proprietary Colossus SSP, we generate revenues by enabling programmatic media buyers to buy ad inventory from our host of publishers and content creators aggregated to provide access to buyers at scale. Advertisers and agencies often have a large portfolio of brands requiring a variety of campaign types and support for a wide array of inventory formats and devices, including OTT/CTV, video and display, in-app, native and audio. Our omni-channel proprietary technology platform is designed to maximize these various advertising channels, which we believe is a further driver of efficiency for our buyers. As of December 31, 2021, the platform is comprised of publishers across multiple channels including OTT/CTV, display, native, in-app, online video (“OLV”), audio and DOOH. Through our platform, media buyers are able to buy more than 70 billion monthly impressions across many unique audiences including multicultural audiences at scale with 10 billion, or 14%, of those impressions being diverse and multicultural- focused, including African Americans, Latin Americans, Asian Americans and LGBTQ+ customers. We charge a standard fee to our publishers for providing access to a host of media buyers on a daily basis. Our publishers, through our platform, had access to more than 80,000 buyers of ad inventory in December 2021. We have a sales team working on behalf of our publishers to enlist more ad buyers across all media channels to generate more revenue for our publishers. The Colossus SSP continues to expand its capabilities to give our content providers more avenues to distribute ad inventory such as OTT/CTV, digital audio, DOOH, etc. and inform our publishers to enhance their ad selling needs by distributing content in various forms to meet the rising demands of the ad buying community.

11

Marketing, Sales, and Distribution

Our sales organization focuses on marketing our technology solution to increase the adoption of our products by existing and new buyers and sellers. We market our products and services to buyers and sellers through our national sales team that operates from various locations across the United States. This team leverages market knowledge and expertise to demonstrate the benefits of programmatic advertising and how we can drive better performance and results for our clients. We are focused on expanding our national sales presence primarily by growing our sales personnel presence in certain states and regions around the country in which we currently operate and/or are seeking to establish a presence. We typically seek to add experienced sales personnel with an established track record and/or verifiable book of business and client relationships.

For the buy-side platform, our sales team has three fundamental components: (1) a consulting services team that advises clients on a more enterprise level in the design and implementation of a digital media strategy; (2) a professional services team with each seller integration to assist sellers in getting the most value from our solution; and (3) our client services team that works closely with clients to manage and/or support campaigns. For Colossus SSP, our professional services team manages each new DSP or publisher/seller integration while the buyer team focuses on the unique challenges and issues arising with our inventory buys.

Our marketing initiatives are focused on managing our brand, increasing market awareness and driving advertising spend to our platform. We often present at industry conferences, create custom events and invest in public relations. In addition, our marketing team advertises online and in other forms of media, creates case studies, sponsors research, writes whitepapers, publishes marketing collateral, generates blog posts and undertakes client research studies.

Competition

Buy-Side Competition

The buy-side digital advertising industry is a very competitive, fast-paced industry with ongoing technological changes, new market entrants and behavioral changes in content consumption. Overall digital advertising spending historically has been highly concentrated in a small number of very large companies that have their own inventory, including Google, Facebook, Comcast, Verizon, AT&T and Amazon, with which we compete for digital advertising inventory and demand. Despite the dominance of large companies, there is still a large addressable market that is highly fragmented and includes many providers of transaction services with which we compete. There has been rapid evolution and consolidation in the advertising technology industry, and we expect these trends to continue, thereby increasing the capabilities and competitive posture of larger companies, particularly those that are already dominant in various ways, and enabling new or stronger competitors to emerge. Based on the current focus of our competitors, there is even more opportunity for engagement in the underserved and multicultural markets on which we focus.

Sell-Side Competition

On the sell-side of the digital advertising industry, competition is robust but more limited in that there were approximately 80 current SSPs in operation as of January 2022, according to MediaMath. We continue to refine our offering so that it remains competitive in scope, ease of use, scalability, speed, data access, price, inventory quality, brand security, customer service, identity protection and other technological features that help sellers monetize their inventory and buyers increase the return on their advertising investment. While our industry is evolving rapidly and becoming increasingly competitive, we believe that our solution enables us to compete favorably on these factors. We achieve this by ensuring that we have the right integrations and implementations in place. Our traffic verification partner is directly integrated within our exchange to ensure inventory quality on a real-time basis. We partner with an accredited Media Rating Council vendor to provide an added layer of security through sophisticated IVT detection and filtration. Our verification with the Trustworthy Accountability Group indicates our status as a trusted player in the digital advertising ecosystem. Through our direct integration with The Media Trust’s Creative Quality Assurance (QA) product, we detect and eliminate the serving of malicious ads in real time, and by transacting on a universal cookie ID, consumers are served more relevant ads, advertisers reach more valuable users and publishers can match their audience data. In the end, we believe these factors enable our sales team to promote the advantages of our platform and drive greater adoption of Colossus SSP.

12

Seasonality in Our Business

In the advertising industry, companies commonly experience seasonal fluctuations in revenue. For example, in our sell-side advertising segment, many advertisers allocate the largest portion of their budgets to the fourth quarter of the calendar year in order to coincide with increased holiday purchasing. Historically, for our buy-side advertising segment, the second and third quarters of the year reflect our highest levels of advertising activity and the first quarter reflects the lowest level of such activity. We expect our revenue to continue to fluctuate based on seasonal factors that affect the advertising industry as a whole.

Human Capital Resources

As of December 31, 2021, we had 57 employees, all of whom are full-time employees. None of our employees are currently covered by a collective bargaining agreement. We have no labor-related work stoppages and believe our relations with our employees are good. We promote a diverse workforce and believe that it fosters innovation and cultivates an environment filled with unique perspectives. As a result, diversity and inclusion are part and parcel of our ability to meet the needs of our customers. Respect for human rights and a commitment to ethical business conduct are fundamental to our business model. In addition, we measure employee engagement on an ongoing basis, as we believe an engaged workforce leads to a more innovative, productive and profitable company. We obtain feedback from our employees to implement programs and processes designed to keep our employees connected with the Company.

Intellectual Property

The protection of our technology and intellectual property is an important component of our success. We rely on intellectual property laws, including trade secret, copyright, patent and trademark laws in the U.S. and abroad, and use contracts, confidentiality procedures, non-disclosure agreements, employee disclosure and invention assignment agreements and other contractual rights to protect our intellectual property.

We own intellectual property related to our owned sites. As of December 31, 2021, we owned approximately four websites and URLs in varying stages of development to support our marketers advertising efforts. We also hold six U.S. registered trademarks and one pending trademark registration application.

Available Information

We file annual, quarterly and special reports, proxy statements and other information with the Securities and Exchange Commission (“SEC”) under the Securities Exchange Act of 1934, as amended (“Exchange Act”). Our filings are available to you on the internet website maintained by the SEC at www.sec.gov. We also maintain an internet website at www.directdigitalholdings.com. We make available, free of charge, on our website our annual reports on Form 10-K, quarterly reports on Form 10-Q, proxy statements, current reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act, as soon as reasonably practicable after such reports are electronically filed with, or furnished to, the SEC. Our website also includes announcements of investor conferences and events, information on our business strategies and results, corporate governance information, and other news and announcements that investors might find useful or interesting. Our website and the information contained therein or connected thereto shall not be deemed to be incorporated into this Annual Report on Form 10-K or any other report we file with or furnish to the SEC.

13

| ITEM 1A. | Risk Factors |

Summary of Material Risk Factors

The following is a summary of some of the risks and uncertainties that could materially adversely affect our business, financial condition and results of operations and could make an investment in our Company speculative or risky. You should be aware that these risk factors and other information may not describe every risk facing our Company. Additional risks and uncertainties not currently known to us may also materially adversely affect our business, financial condition and/or results of operations. You should read this summary together with the more detailed description of each risk factor contained below. Some of these material risks include:

| • | our revenue and operating results are highly dependent on the overall demand for advertising that could be influenced by economic downturns; |

| • | the market for programmatic advertising campaigns is relatively new and evolving, so if this market develops slower or differently than we expect, our business, growth prospects and results of operations would be adversely affected; |

| • | the effects of health epidemics, such as the ongoing global COVID-19 pandemic, have had, and could in the future have, an adverse impact on our business, financial condition and results of operations; |

| • | operational and performance issues with our platform, whether real or perceived, including a failure to respond to technological changes or to upgrade our technology systems, may adversely affect our business, operating results and financial condition; |

| • | a significant inadvertent disclosure or breach of confidential and/or personal information we hold, or of the security of our or our customers’, suppliers’ or other partners’ computer systems could be detrimental to our business, reputation and results of operations; |

| • | if the non-proprietary technology, software, products and services that we use are unavailable, have future terms we cannot agree to, or do not perform as we expect, our business, operating results and financial condition could be harmed; |

| • | unfavorable publicity and negative public perception about our industry, particularly concerns regarding data privacy and security relating to our industry’s technology and practices, and perceived failure to comply with laws and industry self-regulation, could adversely affect our business and operating results; |

| • | if the use of third-party “cookies,” mobile device IDs or other tracking technologies is restricted without similar or better alternatives, our platform’s effectiveness could be diminished and our business, results of operations, and financial condition could be adversely affected; |

| • | the market in which we participate is intensely competitive, and we may not be able to compete successfully with our current or future competitors; |

| • | high customer concentration exposes us to all of the risks faced by our major customers and may subject us to significant fluctuations or declines in revenues; |

| • | we have a limited operating history and, as a result, our past results may not be indicative of future operating performance; |

| • | our business is subject to numerous legal and regulatory requirements and any violation of these requirements or any misconduct by our employees, subcontractors, agents or business partners could harm our business and reputation; |

| • | we are a holding company. Our principal asset is our interest in DDH LLC, and, accordingly, we depend on distributions from DDH LLC to pay our taxes, expenses (including payments under the Tax Receivable Agreement) and dividends. DDH LLC’s ability to make such distributions may be subject to various limitations and restrictions; |

| • | DDH LLC may make distributions of cash to us substantially in excess of the amounts we use to make distributions to our stockholders and pay our expenses (including our taxes and payments under the Tax Receivable Agreement). To the extent we do not distribute such excess cash as dividends on our Class A common stock, DDM would benefit from any value attributable to such cash as a result of its ownership of Class A common stock upon an exchange or redemption of its LLC Units; and |

| • | the requirements of being a public company may strain our resources, divert our management’s attention and affect our ability to attract and retain qualified board members. |

14

Risks Related to our Business

We rely on highly skilled personnel and if we are unable to attract, retain or motivate substantial numbers of qualified personnel or expand and train our sales force, we may not be able to grow effectively.

We rely on highly skilled personnel and if we are unable to attract, retain or motivate substantial numbers of qualified personnel or expand and train our sales force, we may not be able to grow effectively. Our success largely depends on the talents and efforts of key technical, sales and marketing employees and our future success depends on our continuing ability to identify, hire, develop, motivate and retain highly skilled personnel for all areas of our organization. Competition in our industry is intense and often leads to increased compensation and other personnel costs. In addition, competition for employees with experience in our industry can be intense where our development operations are concentrated and where other technology companies compete for management and engineering talent. Our continued ability to compete and grow effectively depends on our ability to attract substantial numbers of qualified new employees and to retain and motivate our existing employees.

The digital advertising industry is intensely competitive, and if we do not effectively compete against current and future competitors, our business, results of operations, and financial condition could be harmed.

We operate in a highly competitive and rapidly changing industry that is subject to changing technology and customer demands and that includes many companies providing competing solutions. With the introduction of new technologies and the influx of new entrants into the market, we expect competition to persist and intensify in the future, which could harm our ability to increase revenue and maintain profitability. New technologies and methods of buying advertising present a dynamic competitive challenge, as market participants offer multiple new products and services aimed at capturing advertising spend.

We compete with smaller, privately-held companies and with public companies such as The Trade Desk, Pubmatic, Magnite, and Acuity Ads. Our current and potential competitors may have significantly more financial, technical, marketing and other resources than we have, allowing them to devote greater resources to the development, promotion, sale and support of their products and services. They may also have more extensive customer bases and broader supplier relationships than we have. As a result, these competitors may be better able to respond quickly to new technologies, develop deeper marketer relationships or offer services at lower prices. Increased competition may result in reduced pricing for our platform, increased sales and marketing expense, longer sales cycles or a decrease of our market share, any of which could negatively affect our revenue and future operating results and our ability to grow our business. These companies may also have greater brand recognition than we have, actively seek to serve our market, and have the power to significantly change the nature of the marketplace to their advantage. Some of our larger competitors have substantially broader product offerings and may leverage their relationships based on other products or incorporate functionality into existing products to gain business in a manner that may discourage customers from using our platform, including through selling at zero or negative margins or product bundling with other services they provide at reduced prices. Customers may prefer to purchase advertising on their own or through another platform without leveraging our buy-side business. Potential customers may also prefer to leverage larger sell-side platforms rather than a new platform regardless of product performance or features. These larger competitors often have broader product lines and market focus and may therefore not be as susceptible to downturns in a particular market. We may also experience negative market perception as a result of being a smaller company than our larger competitors.

We may also face competition from companies that we do not yet know about or do not yet exist. If existing or new companies develop, market or resell competitive high-value marketing products or services, acquire one of our existing competitors or form a strategic alliance with one of our competitors, our ability to compete effectively could be significantly compromised and our results of operations could be harmed.

We may not be able to secure additional financing on favorable terms, or at all, to meet our future capital needs, which may in turn impair our growth.

We intend to continue to grow our business, which may require additional capital to develop new features or enhance our platform, improve our operating infrastructure, finance working capital requirements or acquire complementary businesses and technologies. Accordingly, we may need to engage in additional equity or debt financings to secure additional capital. If we raise additional funds through future issuances of equity or convertible debt securities, our existing stockholders could suffer significant dilution, and any new equity securities we issue could have rights, preferences and privileges superior to those of holders of our Class A common stock. Any debt financing that we secure in the future could involve restrictive covenants relating to our capital raising activities and other financial and operational matters, which may make it more difficult for us to obtain additional capital and to pursue business opportunities. If we are unable to secure additional funding on favorable terms, or at all, when we require it, our ability to continue to grow our business to react to market conditions could be impaired and our business may be harmed.

15

The effects of health pandemics, such as the ongoing global COVID-19 pandemic, have had, and could in the future have, an adverse impact on our business, financial condition and results of operations.

Our business and operations have been and could in the future be adversely affected by health pandemics, such as the global COVID-19 pandemic. The COVID-19 pandemic and efforts to control its spread have curtailed the movement of people, goods and services worldwide, including in the regions in which we and our clients and partners operate, and are significantly impacting economic activity and financial markets. Many marketers have decreased or paused their advertising spending as a response to the economic uncertainty, decline in business activity and other COVID-related impacts, which have negatively impacted some parts of our business, and may continue to negatively impact, our revenue and results of operations, the extent and duration of which we may not be able to accurately predict. In addition, our clients’ and advertisers’ businesses or cash flows have been and may continue to be negatively impacted by the COVID-19 pandemic, which has and may continue to lead them to seek adjustments to payment terms or delay making payments or default on their payables, any of which may impact the timely receipt and/or collectability of our receivables. Typically, we are contractually required to pay for advertising inventory and data suppliers within a negotiated period of time, regardless of whether our clients pay us on time, or at all, and we may not be able to renegotiate better terms. As a result, our business, results of operations, and financial condition may be adversely impacted.

Our operations are subject to a range of external factors related to the COVID-19 pandemic that are not within our control. We have taken precautionary measures intended to minimize the risk of the spread of the virus to our employees, partners and clients, and the communities in which we operate. A wide range of governmental restrictions were previously, and may again be, imposed on our employees, clients and partners’ physical movement to limit the spread of COVID-19. There can be no assurance that precautionary measures, whether adopted by us or imposed by others, will be effective, and such measures could negatively affect our sales, marketing and client service efforts, delay and lengthen our sales cycles, decrease our employees’, clients’ or partners’ productivity, or create operational or other challenges, any of which could harm our business, results of operations and financial condition.

Our customers or potential customers, particularly in industries most impacted by the COVID-19 pandemic, including the retail, restaurant, hotel, hospitality, consumer discretionary, airline, and oil and gas industries and companies whose customers operate in impacted industries, may reduce their technology or sales and marketing spending or delay their sales transformation initiatives, which could materially and adversely impact our business.

The economic uncertainty caused by the COVID-19 pandemic has made and may continue to make it difficult for us to forecast revenue and operating results and to make decisions regarding operational cost structures and investments. We have committed, and we plan to continue to commit, resources to grow our business, including to expand our international presence, employee base and technology development, and such investments may not yield anticipated returns, particularly if worldwide business activity continues to be impacted by the COVID-19 pandemic. The duration and extent of the impact from the COVID-19 pandemic depend on future developments that cannot be accurately predicted at this time, and if we are not able to respond to and manage the impact of such events effectively, our business may be harmed.

High customer concentration exposes us to various risks faced by our major customers and may subject us to significant fluctuations or declines in revenues.

A limited number of our major customers have contributed a significant portion to our revenues in the past. Our revenue from the top two largest customers accounted for approximately 41% and 25% of our total revenues in the fiscal years ended December 31, 2021 and 2020, respectively. Our revenue from our top ten largest customers accounted for approximately 70% and 59% of our total revenues in the fiscal years ended December 31, 2021 and 2020, respectively. Although we continually seek to diversify our customer base, we cannot assure you that the proportion of the revenue contribution from these customers to our total revenues will decrease in the near future. Dependence on a limited number of major customers will expose us to the risks of substantial losses and may increase our accounts receivable and extend its turn-over days if any of them reduces or even ceases business with us. Specifically, any one of the following events, among others, may cause material fluctuations or declines in our revenues and have a material and adverse effect on our business, financial condition, results of operations and prospects:

| • | an overall decline in the business of one or more of our significant customers; |

| • | the decision by one or more of our significant customers to switch to our competitors; |

| • | the reduction in the prices for our services agreed by one or more of our significant customers; or |

| • | the failure or inability of any of our significant customers to make timely payment for our services. |

16

Operational and performance issues with our platform, whether real or perceived, including a failure to respond to technological changes or to upgrade our technology systems, may adversely affect our business, operating results and financial condition.

We depend upon the sustained and uninterrupted performance of our platform to manage our advertising inventory supply; acquire advertising inventory for each campaign; collect, process and interpret data; and optimize campaign performance in real time and provide billing information to our financial systems. If our platform cannot scale to meet demand, if there are errors in our execution of any of these functions on our platform, or if we experience outages, then our business may be harmed.

Our platform is complex and multifaceted. Operational and performance issues could arise from the platform itself or from outside factors, such as cyberattacks or other third-party attacks. Errors, failures, vulnerabilities or bugs have been found in the past, and may be found in the future. Our platform also relies on third-party technology and systems to perform properly. It is often used in connection with computing environments utilizing different operating systems, system management software, equipment and networking configurations, which may cause errors in, or failures of, our platform or such other computing environments. Operational and performance issues with our platform could include the failure of our user interface, outages, errors during upgrades or patches, discrepancies in costs billed versus costs paid, unanticipated volume overwhelming our databases, server failure or catastrophic events affecting one or more server facilities. While we have built redundancies in our systems, full redundancies do not exist. Some failures will shut our platform down completely, others only partially. We provide service-level agreements to some of our customers, and if our platform is not available for specified amounts of time or if there are failures in the interaction between our platform, partner platform and third-party technologies, we may be required to provide credits or other financial compensation to our customers.

As we grow our business, we expect to continue to invest in technology services and equipment. Without these improvements, our operations might suffer from unanticipated system disruptions, slow transaction processing, unreliable service levels, impaired quality or delays in reporting accurate information regarding transactions in our platform, any of which could negatively affect our reputation and ability to attract and retain customers. In addition, the expansion and improvement of our systems and infrastructure may require us to commit substantial financial, operational and technical resources, with no assurance our business will grow. If we fail to respond to technological change or to adequately maintain, expand, upgrade and develop our systems and infrastructure in a timely fashion, our growth prospects and results of operations could be adversely affected.

Operational and performance issues with our platform could also result in negative publicity, damage to our brand and reputation, loss of or delay in market acceptance of our platform, increased costs or loss of revenue, loss of the ability to access our platform, loss of competitive position or claims by customers for losses sustained by them. Alleviating problems resulting from such issues could require significant expenditures of capital and other resources and could cause interruptions, delays or the cessation of our business, any of which may adversely affect our operating results and financial condition.

A significant inadvertent disclosure or breach of confidential and/or personal information we hold, or of the security of our or our customers’, suppliers’ or other partners’ computer systems, could be detrimental to our business, reputation and results of operations.

Portions of our business require the storage, transmission and utilization of data, including access to personal information, much of which must be maintained on a confidential basis. These activities may in the future make us a target of cyber-attacks by third parties seeking unauthorized access to the data we maintain and to which we provide access, including our customer data, or to disrupt our ability to provide service through the Colossus SSP. Based on the types and volume of personal data on our systems, we believe that we are a particularly attractive target for such breaches and attacks.

In recent years, the frequency, severity and sophistication of cyber-attacks, computer malware, viruses, social engineering, and other intentional misconduct by computer hackers has significantly increased, and government agencies and security experts have warned about the growing risks of hackers, cyber criminals and other potential attackers targeting information technology systems. Such third parties could attempt to gain entry to our systems for the purpose of stealing data or disrupting the systems. In addition, our security measures may also be breached due to employee error, malfeasance, system errors or vulnerabilities, including vulnerabilities of our vendors, suppliers, their products or otherwise. Third parties may also attempt to fraudulently induce employees or customers into disclosing sensitive information such as usernames, passwords or other information to gain access to our customers’ data or our data, including intellectual property and other confidential business information.

We currently serve the majority of Colossus SSP functions from third-party data center hosting facilities. While we and our third-party cloud providers have implemented security measures designed to protect against security breaches, these measures could fail or may be insufficient, particularly as techniques used to sabotage or obtain unauthorized access to systems change frequently and generally are not recognized until launched against a target, resulting in the unauthorized disclosure, modification, misuse, destruction or loss of our or our customers’ data or other sensitive information. Any failure to prevent or mitigate security breaches and improper access to or disclosure of the data we maintain, including personal information, could result in litigation, indemnity obligations, regulatory enforcement actions, investigations, fines, penalties, mitigation and remediation costs, disputes, reputational harm, diversion of management’s attention, and other liabilities and damage to our business.

17

We believe we have taken appropriate measures to protect our systems from intrusion, but we cannot be certain that advances in criminal capabilities, discovery of new vulnerabilities in our systems and attempts to exploit those vulnerabilities, physical system or facility break-ins and data thefts or other developments will not compromise or breach the technology protecting our systems and the information we possess.