As filed with the Securities and Exchange Commission on April 21, 2023

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM S-3

REGISTRATION STATEMENT

UNDER THE SECURITIES ACT OF 1933

Direct Digital Holdings, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 87-2306185 | |

|

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

1177 West Loop South, Suite 1310

Houston, TX 77207

(832) 402-1051

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Mark Walker

Chairman and Chief Executive Officer

Keith Smith

President

Direct Digital Holdings, Inc.

1177 West Loop South, Suite 1310

Houston, TX 77207

(832) 402-1051

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

|

Phyllis Young Rakesh Gopalan David S. Wolpa McGuireWoods LLP 201 North Tyron Street, Suite 3000 Charlotte, NC 28202 (704) 343-2000

|

Approximate date of commencement of proposed sale to the public: From time to time after the effective date of this registration statement as determined by the registrant.

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box: ¨

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box: x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ¨

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | ¨ | Accelerated filer | ¨ |

| Non-accelerated filer | x | Smaller reporting company | x |

| Emerging growth company | x |

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act.

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the Registration Statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED APRIL 21, 2023

PROSPECTUS

$300,000,000

CLASS A COMMON STOCK

PREFERRED STOCK

DEBT SECURITIES

WARRANTS

UNITS

This prospectus will allow us to issue, from time to time at prices and on terms to be determined at or prior to the time of the offering, up to $300 million in aggregate principal amount of our Class A common stock, preferred stock, debt securities, warrants and/or units in one or more offerings. We may offer these securities separately or together in units. We may also offer common stock or preferred stock upon conversion of or exchange for the debt securities and common stock or preferred stock or debt securities upon the exercise of warrants.

This prospectus describes the general terms of the securities we may offer and the general manner in which these securities will be offered. We will provide you with the specific terms of any offering in one or more supplements to this prospectus. The prospectus supplements will specify the securities being offered and also the specific manner in which the securities will be offered and may also supplement, update or amend information contained in this document. You should read this prospectus and any prospectus supplement, as well as any documents incorporated by reference into this prospectus or any prospectus supplement, carefully before you invest.

Our securities may be sold directly by us to you, through agents designated from time to time or to or through underwriters or dealers. For additional information on the methods of sale, you should refer to the section titled “Plan of Distribution” in this prospectus and in the applicable prospectus supplement. If any underwriters or agents are involved in the sale of our securities with respect to which this prospectus is being delivered, the names of such underwriters or agents and any applicable fees, commissions or discounts and over-allotment options will be set forth in a prospectus supplement. The price to the public of such securities and the net proceeds that we expect to receive from such sale will also be set forth in a prospectus supplement.

Our Class A common stock is listed on the Nasdaq Capital Market, under the symbol “DRCT” and our warrants issued in connection with our initial public offering (the “Public Warrants”) are listed on the Nasdaq Capital market under the symbol “DRCTW.” The last reported sale price for our Class A common stock on April 20, 2023 on the Nasdaq Capital Market was $3.16 per share. The last reported sale price for our Public Warrants on March 30, 2023 on the Nasdaq Capital Market was $0.75 per warrant.

As of April 17, 2023, the aggregate market value of our public float, calculated according to General Instruction I.B.6. of Form S-3, is approximately $6,800,000, based on 2,902,200 shares of Class A common stock outstanding as of April 17, 2023, of which 2,860,000 shares of our Class A common stock are held by non-affiliates. We have not offered any securities pursuant to General Instruction I.B.6. of Form S-3 during the prior 12 calendar month period that ends on, and includes, the date of this prospectus. Pursuant to General Instruction I.B.6 of Form S-3, in no event will we sell our Class A common stock in a public primary offering with a value exceeding more than one-third of our public float in any 12-month period so long as our public float remains below $75,000,000.

Investing in our securities involves a high degree of risk. Before deciding whether to invest in our securities, you should consider carefully the risks that we have described on page 7 of this prospectus under the caption “Risk Factors.” We may include specific risk factors in supplements to this prospectus under the caption “Risk Factors.” This prospectus may not be used to sell our securities unless accompanied by a prospectus supplement.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2023

TABLE OF CONTENTS

This prospectus is part of a registration statement on Form S-3 (this “Registration Statement”) that we filed with the Securities and Exchange Commission (the “SEC”), utilizing a “shelf” registration process. Under this shelf registration process, we may offer shares of our Class A common stock, preferred stock, various series of debt securities and/or warrants, either individually or in units, in one or more offerings, with a total value of up to $300,000,000. This prospectus provides you with a general description of the securities we may offer. Each time we offer a type or series of securities under this prospectus, we will provide a prospectus supplement that will contain specific information about the terms of that offering.

This prospectus does not contain all of the information included in the registration statement. For a more complete understanding of the offering of the securities, you should refer to the registration statement, including its exhibits. A prospectus supplement may also add, update or change information contained or incorporated by reference in this prospectus. However, no prospectus supplement will offer a security the offering of which is not registered and described in this prospectus at the time of its effectiveness. This prospectus, together with the applicable prospectus supplements and the documents incorporated by reference into this prospectus, includes all material information relating to the offering of securities under this prospectus. You should carefully read this prospectus, the applicable prospectus supplement, the information and documents incorporated herein by reference and the additional information under the heading “Where You Can Find More Information” before making an investment decision.

You should rely only on the information we have provided or incorporated by reference in this prospectus or any prospectus supplement. We have not authorized anyone to provide you with information different from that contained or incorporated by reference in this prospectus. No dealer, salesperson or other person is authorized to give any information or to represent anything not contained or incorporated by reference in this prospectus. You must not rely on any unauthorized information or representation. This prospectus is an offer to sell only the securities offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so. You should assume that the information in this prospectus or any prospectus supplement is accurate only as of the date on the front of the document and that any information we have incorporated herein by reference is accurate only as of the date of the document incorporated by reference, regardless of the time of delivery of this prospectus or any sale of a security.

We further note that the representations, warranties and covenants made by us in any agreement that is filed as an exhibit to any document that is incorporated by reference in the accompanying prospectus were made solely for the benefit of the parties to such agreement, including, in some cases, for the purpose of allocating risk among the parties to such agreements, and should not be deemed to be a representation, warranty or covenant to you. Moreover, such representations, warranties or covenants were accurate only as of the date when made. Accordingly, such representations, warranties and covenants should not be relied on as accurately representing the current state of our affairs.

This prospectus may not be used to consummate sales of our securities, unless it is accompanied by a prospectus supplement. To the extent there are inconsistencies between any prospectus supplement, this prospectus and any documents incorporated by reference, the document with the most recent date will control.

Unless the context otherwise requires, “Direct Digital,” “Direct Digital Holdings,” “DDH,” “we,” “us,” “our” and similar terms refer to Direct Digital Holdings, Inc.

1

The following is a summary of what we believe to be the most important aspects of our business and the offering of our securities under this prospectus. We urge you to read this entire prospectus, including the more detailed consolidated financial statements, notes to the consolidated financial statements and other information incorporated by reference from our other filings with the SEC or included in any applicable prospectus supplement. Investing in our securities involves risks. Therefore, carefully consider the risk factors set forth in any prospectus supplements and in our most recent annual and quarterly filings with the SEC, as well as other information in this prospectus and any prospectus supplements and the documents incorporated by reference herein or therein, before purchasing our securities. Each of the risk factors could adversely affect our business, operating results and financial condition, as well as adversely affect the value of an investment in our securities.

Company Overview

We are an end-to-end, full-service programmatic advertising platform primarily focused on providing advertising technology, data-driven campaign optimization and other solutions to underserved and less efficient markets on both the buy- and sell-side of the digital advertising ecosystem. Direct Digital Holdings, Inc., incorporated as a Delaware corporation on August 23, 2021, is the holding company for Direct Digital Holdings, LLC (“DDH LLC”), the business formed by our founders in 2018 through the acquisitions of Huddled Masses, LLC (“Huddled Masses”) and Colossus Media, LLC (“Colossus Media”). Colossus Media operates our proprietary sell-side programmatic platform operating under the trademarked banner of Colossus SSP™. Huddled Masses is the platform for the buy-side of our business. In 2020, we acquired Orange142, LLC (“Orange142”) to further bolster our overall programmatic buy-side advertising platform and enhance our offerings across multiple industry verticals such as travel, healthcare, education, financial services and consumer products with particular emphasis on small and mid-sized businesses transitioning into digital with growing digital media budgets. In February 2022, we completed our initial public offering and certain organizational transactions which resulted in our current structure.

In the digital advertising space, buyers, particularly small and mid-sized businesses, can potentially achieve significantly higher return on investment (“ROI”) on their advertising spend compared to traditional media advertising by leveraging data-driven over-the-top/connected TV (“OTT/CTV”), video and display, in-app, native and audio advertisements that are delivered both at scale and on a highly targeted basis. Traditional (non-digital) advertising, such as broadcast TV or print media, follows the “spray and pray” approach to reach out to the public, but the ROI from using such traditional (non-digital) advertising campaigns is mostly unpredictable. On the other hand, digital advertising is heavily data-driven and can provide real-time details of targeted advertising campaigns and outcomes. On the sell-side, publishers can more successfully sell their advertising inventory in a programmatic manner by sharing data and information about their digital audiences at scale on an individualized basis, which helps buyers to better target audiences.

2

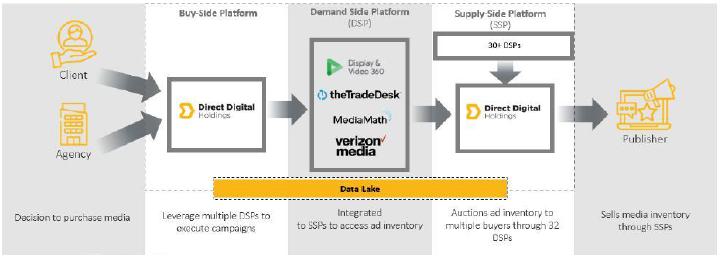

Programmatic Marketplace Transaction

The Buy Side

On the buy side of the digital supply chain, digital advertising is the practice of delivering promotional content to users through various online and digital channels and leverages multiple channels, platforms such as social media, email, search engines, mobile applications and websites to display advertisements and messages to audiences. Traditional (non-digital) advertising follows the “spray and pray” approach to reach out to the public, but the ROI is mostly unpredictable. On the other hand, digital advertising is heavily data-driven and can give real-time details of advertising campaigns and outcomes. The availability of user data and rich targeting capabilities makes digital advertising an effective and important tool for businesses to connect with their audiences.

We have aligned our business strategy to capitalize on significant growth opportunities due to fundamental market shifts and industry inefficiencies. Several trends, happening in parallel, are revolutionizing the way that advertising is bought and sold. Specifically, the rise of the internet has led to a wholesale change in the way that media is consumed and monetized, as ads can be digitally delivered on a 1-to-1 basis. In traditional methods of advertising, such as broadcast TV, ads can target a specific network, program, or geography, but not a single household or individual as digital and OTT/CTV ads can. Additionally, we expect that the continued destabilization, including the phase out of digital “cookies” in 2023, will (i) create more opportunities for technology companies that provide next-generation CTV and digital solutions and (ii) minimize performance disruption for advertisers and agencies.

The Buy-Side Business: Huddled Masses & Orange142

The buy-side segment of our business, operated through Huddled Masses, which has been in operation since 2012, and Orange142, which has been in operation since 2013, enables us to provide the programmatic purchase of advertising on behalf of our clients. Programmatic advertising is rapidly taking market share from traditional ad sales channels, which require more staffing, offer less transparency and involve higher costs to buyers. Our buy-side platform provides the technology for first-party data management, media purchases, campaign execution and analytics, and therefore helps drive increased ROI across a wide array of digital media channels. Because our technology accesses several of the large demand side platforms (“DSPs”), our platform is able to leverage customer insights across multiple DSPs to drive campaign performance and ROI for our clients. By taking this DSP-agnostic approach, our platform provides the broadest market access for our clients so that clients can easily buy ads on desktop, mobile, connected TV, linear TV, streaming audio and digital billboards. Additionally, our technology has unique visibility across inventory to create customized audience segments at scale. Depending on the client objective and DSP we choose, our buy-side platform provides forecasting and deep market insights to our clients to improve their return-on-advertising spend across channels.

The buy-side segment businesses offer technology-enabled advertising solutions and strategic planning to clients. In particular, our buy-side platform focuses on small to-mid-sized clients and enable them to leverage programmatic technology to engage their potential customers more directly, on a one-on-one basis, in any local market, with specificity to media device and footprint. Our technology leverages data to assess where our clients’ potential customers are in the decision-making process and manage campaign pacing and optimization based on data-driven analytics to drive the purchasing decision or encourage the call to action. With marketing budgets typically more limited and operating footprints generally more local or state-to-state, we believe small and mid-sized businesses are focused primarily on ROI-based results that deliver precise advertising and measurable campaign success to level the playing field with larger competitors. Serving the needs of approximately 218 small and mid-sized clients for the fiscal year ended December 31, 2022, the buy-side of our business leverages the insights of leading DSPs, such as The Trade Desk, Xandr, Google DV360, MediaMath and others, to drive increased advertising ROI and reduced customer acquisition costs for our clients. The result is the benefit to our buy-side clients in that they enjoy a more even playing field compared to larger advertisers by driving more effective marketing and advertising in local markets that are compatible to their business footprint.

We believe that we have a unique competitive advantage due to our data-driven technology that allows us to provide front-end, buy-side planning for our small and mid-sized clients, coupled with our proprietary Colossus SSP where we can curate the last-mile in the execution process to drive higher ROI. In our business and throughout this prospectus, we use the terms client and customer interchangeably.

3

The Sell Side

On the sell side of the digital supply chain, the supply-side platform (“SSP”), is an ad technology platform used by publishers to sell, manage and optimize the ad inventory on their websites in an automated and effective way. The SSPs help the publishers monetize the display ads, video ads, and native ads on their websites and mobile apps. The SSPs have enhanced their functionalities over the years and have included ad exchange mechanisms to efficiently manage their ad inventory. Also, SSPs allow the publishers to connect to DSPs directly instead of connecting through ad exchanges. The SSP allows publishers’ inventory to be opened up and made available to advertisers they may not be able to directly connect with. SSPs sell ad inventories in many ways — for example, directly to ad networks, via direct deals with DSPs, and most commonly via real-time bidding (“RTB”) auctions. The publisher makes its ad inventory available on an SSP and invites advertisers to bid based on the user’s data received. Each time the publisher’s web page loads, an ad request is sent to multiple ad exchanges and, in some cases, to the demand side platform directly from the SSP. In the case of RTB media buys, many DSPs would place bids to the impressions being offered by the publisher during the auction. The advertiser that bids a higher amount compared to other advertisers will win the bid and pay the second highest price for the winning impression to serve the ads.

The Sell-Side Platform: Colossus SSP

Colossus Media, which has been in operation since 2017, is our proprietary sell-side programmatic platform operating under the trademarked banner of Colossus SSP™. Our sell-side segment maintains a proprietary platform, Colossus SSP, which is an advertising technology platform used by publishers to manage, sell and optimize available inventory (ad space) on their websites and mobile apps in an automated way. During the year ended December 31, 2022, we processed approximately 3.4 trillion bid requests and had connections to approximately 19 DSPs and served approximately 114,000 buyers. Each impression or transaction occurs in a fraction of a second. Given that most transactions take place in an auction/bidding format, we continue to make investment across the platform to further reduce the processing time. In addition to the robust infrastructure supporting our platform, it is also critical that we align with key industry partners in the digital supply chain.

Colossus SSP is agnostic to any specific demand side platform. To that end, our proprietary Colossus SSP is integrated into several leading DSPs both directly, through Bidswitch, and indirectly, through such platforms as Xandr/AppNexus, The Trade Desk, Google 360, Verizon Media, MediaMath, Zeta Global, Samsung, Pulsepoint, and others. We continue to add new DSP partners especially where we believe the DSP might offer a unique advertising base seeking to target our multicultural audiences at scale. We help our advertiser clients efficiently reach diverse communities including African Americans, Latin Americans, Asian Americans and LGBTQ+ customers in highly targeted campaigns. This business began as a trading desk supporting advertisers’ desires to reach diverse audiences and has evolved into the preeminent ad tech platform to support this goal. We partner with both large publishers such as Hearst, MediaVine, Gannett, and several others, as well as smaller publishers such as Ebony Magazine, People Magazine, Newsweek, Blavity, La Nacion and many others.

Colossus SSP offers our publisher clients’ ad inventory to existing small and mid-sized buy-side clients at Huddled Masses and Orange142, and other major DSP clients of Colossus Media, which enables our buy-side technology to curate and manage client outcomes more effectively. In addition, because it is a stand-alone platform, Colossus SSP offers its ad inventory to larger, multinational, clients seeking more authentic advertising access to unique, often diverse and multicultural, audiences.

Our proprietary Colossus SSP was custom developed with a view towards the specific challenges facing small and mid-sized publishers with the belief that often smaller publishers offer a more engaged, highly-valued, unique following but experienced technological and budgetary constraints on the path to monetization. Connecting our buy-side business to Colossus SSP completes the end-to-end solution for our small to-mid-sized buy-side customers while creating additional revenue opportunities for our Colossus SSP publishers.

Our business strategy on the sell-side also presents significant growth potential, as we believe we are well positioned to be able to bring underserved multicultural publishers into the advertising ecosystem, thereby increasing our value proposition across all clients including our large clients. We have proprietary rights to the Colossus SSP via a license agreement with a third-party developer. We believe the Colossus SSP is the last-mile of delivery for our buy-side clients in that our technology curates unique, highly optimized audiences informed by data analytics, artificial intelligence and algorithmic machine-learning technology, resulting in increased campaign performance.

4

The Data Management Platform

We also leverage a sophisticated data management platform, which is DDH’s proprietary data collection and data marketing platform used to gather first-party data, market intelligence and audience segmentation information to support campaign optimization efforts for buy-side clients, Colossus SSP clients and third-party clients. Our combined platform offers results in an enhanced, highly loyal client base, particularly on the buy-side.

Our Structure

In connection with our initial public offering in February 2022, we effected a series of transactions whereby Direct Digital Holdings, Inc. became (i) the sole managing member of DDH LLC, (ii) the holder of 100% of the voting interests of DDH LLC and (iii) the holder of 19.7% of the economic interests of DDH LLC, commonly referred to as an “Up-C” structure, which is often used by partnership and limited liability companies and allows DDH, Direct Digital Management, LLC (“DDM”), a Delaware limited liability company indirectly owned by Mark Walker, our chairman and chief executive officer, and Keith Smith, our president, to retain its equity ownership in DDH LLC and to continue to realize tax benefits associated with owning interests in an entity that is treated as a partnership, or “passthrough” entity, for U.S. federal income tax purposes. DDM holds economic nonvoting units (“LLC Units”) in DDH LLC and noneconomic voting equity interests in the form of the Class B common stock in Direct Digital Holdings. One of the tax benefits to DDM associated with this structure is that future taxable income of DDH LLC that is allocated to DDM will be taxed on a pass-through basis and therefore will not be subject to corporate taxes at the entity level. Additionally, DDM may, from time to time, redeem or exchange its LLC Units for shares of our Class A common stock on a one-for-one basis. The Up-C structure also provides DDM with potential liquidity that holders of non-publicly traded limited liability companies are not typically afforded. If we ever generate sufficient taxable income to utilize the tax benefits, Digital Direct Holdings expects to benefit from the Up-C structure because, in general, we expect cash tax savings in amounts equal to 15% of certain tax benefits arising from such redemptions or exchanges of DDM’s LLC Units for Class A common stock or cash and certain other tax benefits covered by a tax receivables agreement among Direct Digital Holdings, DDH LLC and DDM.

Company and Other Information

Our principal executive office is located at 1177 West Loop South, Suite 1310, Houston, Texas 77027. Our telephone number is (832) 402-1051. Our main internet address is www.directdigitalholdings.com. We do not incorporate the information on or accessible through our website into this prospectus, and you should not consider any information on, or that can be accessed through, our website as a part of this prospectus.

Implications of Being an Emerging Growth Company and a Smaller Reporting Company

We are an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”), and may remain an emerging growth company until December 31, 2026, or until such earlier time as we have more than $1.07 billion in annual revenue, we become a “large accelerated filer” under SEC rules, or we issue more than $1 billion of non-convertible debt over a three-year period. The JOBS Act contains provisions that, among other things, reduce certain reporting requirements for an “emerging growth company.” For so long as we remain an emerging growth company, we are permitted and plan to rely on exemptions from certain disclosure requirements that are applicable to other public companies that are not emerging growth companies.

These exemptions include reduced disclosure obligations regarding executive compensation. In addition, as an emerging growth company, we are not required to conduct votes seeking approval, on an advisory basis, of the compensation of our named executive officers or the frequency with which such votes must be conducted. We may take advantage of some or all of these exemptions until such time as we are no longer an emerging growth company.

5

We are also a “smaller reporting company,” meaning that the market value of our stock held by non-affiliates is less than $700 million and our annual revenue was less than $100 million during the most recently completed fiscal year. We may continue to be a smaller reporting company if either (i) the market value of our stock held by non-affiliates is less than $250 million or (ii) our annual revenue was less than $100 million during the most recently completed fiscal year and the market value of our stock held by non-affiliates was less than $700 million. If we are a smaller reporting company at the time we cease to be an emerging growth company, we may continue to rely on exemptions from certain disclosure requirements that are available to smaller reporting companies. For so long as we remain a smaller reporting company, we are permitted and intend to rely on exemptions from certain disclosure and other requirements that are applicable to other public companies that are not applicable to a smaller reporting company.

6

Investing in our securities involves risks. You should carefully consider the risks, uncertainties and other factors described in our most recent Annual Report on Form 10-K, as supplemented and updated by subsequent Quarterly Reports on Form 10-Q and Current Reports on Form 8-K that we have filed or will file with the SEC, and in other documents which are incorporated by reference into this prospectus, as well as the risk factors and other information contained in or incorporated by reference into any accompanying prospectus supplement before investing in any of our securities. Our business, financial condition, results of operations, cash flows or prospects could be materially and adversely affected by any of these risks. The risks and uncertainties described in the documents incorporated by reference herein are not the only risks and uncertainties that you may face.

For more information about our SEC filings, please see “Where You Can Find More Information” and “Incorporation of Certain Information by Reference.”

7

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus, including the documents that we incorporate by reference, contains forward-looking statements within the meaning of federal securities laws and which are subject to certain risks, trends and uncertainties. We use words such as “could,” “would,” “may,” “might,” “will,” “expect,” “likely,” “believe,” “continue,” “anticipate,” “estimate,” “intend,” “plan,” “project” and other similar expressions to identify forward-looking statements, but not all forward-looking statements include these words. All of our forward-looking statements involve estimates and uncertainties that could cause actual results to differ materially from those expressed in or implied by the forward-looking statements. Accordingly, any such statements are qualified in their entirety by reference to the information described under the caption “Risk Factors” and elsewhere in this prospectus.

The forward-looking statements contained in this prospectus are based on assumptions that we have made in light of our industry experience and our perceptions of historical trends, current conditions, expected future developments and other factors we believe are appropriate under the circumstances. As you read and consider this prospectus, you should understand that these statements are not guarantees of performance or results. They involve risks, uncertainties (many of which are beyond our control) and assumptions.

Although we believe that these forward-looking statements are based on reasonable assumptions, you should be aware that many factors could affect our actual operating and financial performance and cause our performance to differ materially from the performance expressed in or implied by the forward-looking statements. We believe these factors include, but are not limited to, the following:

| · | our dependence on the overall demand for advertising, which could be influenced by economic downturns; |

| · | any slow-down or unanticipated development in the market for programmatic advertising campaigns; |

| · | the effects of health epidemics; |

| · | operational and performance issues with our platform, whether real or perceived, including a failure to respond to technological changes or to upgrade our technology systems; |

| · | any significant inadvertent disclosure or breach of confidential and/or personal information we hold, or of the security of our or our customers’, suppliers’ or other partners’ computer systems; |

| · | any unavailability or non-performance of the non-proprietary technology, software, products and services that we use; |

| · | unfavorable publicity and negative public perception about our industry, particularly concerns regarding data privacy and security relating to our industry’s technology and practices, and any perceived failure to comply with laws and industry self-regulation; |

| · | restrictions on the use of third-party “cookies,” mobile device IDs or other tracking technologies, which could diminish our platform’s effectiveness; |

| · | any inability to compete in our intensely competitive market; |

| · | any significant fluctuations caused by our high customer concentration; |

| · | our limited operating history, which could result in our past results not being indicative of future operating performance; |

| · | any violation of legal and regulatory requirements or any misconduct by our employees, subcontractors, agents or business partners; |

8

| · | any strain on our resources, diversion of our management’s attention or impact on our ability to attract and retain qualified board members as a result of being a public company; |

| · | as a holding company, we depend on distributions from DDH LLC to pay our taxes, expenses (including payments under that certain Tax Receivable Agreement, dated February 15, 2022, by and among the Company, DDH LLC and DDM (such agreement, the “Tax Receivable Agreement”)) and dividends; and |

| · | DDH LLC may make distributions of cash to us substantially in excess of the amounts we use to make distributions to our stockholders and pay our expenses (including our taxes and payments under the Tax Receivable Agreement), which, to the extent not distributed as dividends on our Class A common stock, would benefit DDM as a result of its ownership of our Class A common stock upon an exchange or redemption of its LLC Units. |

Should one or more of these risks or uncertainties materialize, or should any of these assumptions prove to be incorrect, our actual operating and financial performance may vary in material respects from the performance projected in these forward-looking statements. Further, any forward-looking statement speaks only as of the date on which it is made, and except as required by law, we undertake no obligation to update any forward-looking statement contained in this prospectus or any accompanying prospectus supplement to reflect events or circumstances after the date on which it is made or to reflect the occurrence of anticipated or unanticipated events or circumstances. New factors that could cause our business not to develop as we expect emerge from time to time, and it is not possible for us to predict all of them. Further, we cannot assess the impact of each currently known or new factor on our results of operations or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements.

9

We cannot assure you that we will receive any proceeds in connection with securities that may be offered pursuant to this prospectus. Unless otherwise indicated in the applicable prospectus supplement, we may use any net proceeds from the sale of securities under this prospectus for working capital and general corporate purposes, including a potential future acquisition of, or investment in, technologies or businesses that complement our business. As a result, our management will have broad discretion to allocate the net proceeds, if any, we receive in connection with securities offered pursuant to this prospectus for any purpose. Pending application of the net proceeds as described above, we may initially invest the net proceeds in short-term, investment-grade, interest-bearing securities or apply them to the reduction of short-term indebtedness.

10

The following description summarizes the material terms of our capital stock. Because it is only a summary, it does not contain all the information that may be important to you. For a complete description of our capital stock, you should refer to our Amended and Restated Certificate of Incorporation and our Amended and Restated Bylaws, each as amended from time to time, and to the provisions of applicable Delaware law.

Common Stock

Our Class A common stock is traded on the Nasdaq Capital Market under the symbol “DRCT.”

The authorized capital stock of Direct Digital Holdings consists of 160,000,000 shares of Class A common stock, with $0.001 par value, 20,000,000 shares of Class B common stock, par value $0.001 per share and 10,000,000 shares of preferred stock, par value $0.001 per share.

Class A Common Stock

Voting Rights

Holders of our Class A common stock are entitled to cast one vote per share. Holders of our Class A common stock are not entitled to cumulate their votes in the election of directors. Generally, all matters to be voted on by stockholders must be approved by a majority (or, in the case of election of directors, by a plurality) of the votes entitled to be cast by all holders of Class A common stock and Class B common stock present in person or represented by proxy, voting together as a single class. Except as otherwise provided by law, amendments to the amended and restated certificate of incorporation must be approved by a majority of the combined voting power of all shares of Class A common stock and Class B common stock, voting together as a single class.

Dividend Rights

Any dividend or distribution paid or payable to the holders of shares of Class A common stock shall be paid pro rata, on an equal priority, pari passu basis; provided, however, that if a dividend or distribution is paid in the form of Class A common stock (or rights to acquire shares of Class A common stock), then the holders of the Class A common stock shall receive Class A common stock (or rights to acquire shares of Class A common stock).

Liquidation Rights

In the event of our liquidation, dissolution or winding-up, upon the completion of the distributions required with respect to any series of redeemable convertible preferred stock that may then be outstanding, our remaining assets legally available for distribution to stockholders shall be distributed on an equal priority, pro rata basis to the holders of Class A common stock, unless different treatment is approved by the majority of the voting power of the outstanding shares of Class A common stock and Class B common stock.

Other Matters

No shares of Class A common stock are subject to redemption or have preemptive rights to purchase additional shares of Class A common stock. Holders of shares of our Class A common stock do not have subscription, redemption or conversion rights. There are no redemption or sinking fund provisions applicable to the Class A common stock.

Class B Common Stock

The description of our Class B common stock in this item is for information purposes only. All of our outstanding Class B common stock is owned by DDM.

11

Issuance of Class B Common Stock with LLC Units

Shares of Class B common stock will only be issued in the future to the extent necessary to maintain a one-to-one ratio between the number of its LLC Units and the number of shares of Class B common stock issued to DDM. Shares of Class B common stock are transferable only together with an equal number of LLC Units. Shares of Class B common stock will be cancelled on a one-for-one basis if we, at the election of DDM, redeem or exchange its LLC Units pursuant to the terms of the Amended and Restated Limited Liability Agreement of DDH LLC, dated February 15, 2022, by and between Direct Digital Holdings and DDM (the “DDH LLC Agreement”).

Voting Rights

Holders of Class B common stock are entitled to cast one vote per share. Holders of our Class B common stock are entitled to cumulate their votes in the election of directors. The voting power afforded to DDM by its shares of Class B common stock will be automatically and correspondingly reduced as we redeem the LLC Units held by DDM because an equal number of its shares of Class B common stock will be cancelled.

Generally, all matters to be voted on by stockholders must be approved by a majority (or, in the case of election of directors, by a plurality) of the votes entitled to be cast by all Class A and Class B stockholders present in person or represented by proxy, voting together as a single class. Except as otherwise provided by law, amendments to the amended and restated certificate of incorporation must be approved by a majority of the combined voting power of all shares of Class A common stock and Class B common stock, voting together as a single class. There will be a separate vote of the Class B common stock in the following circumstances:

| · | if we amend, alter or repeal any provision of the amended and restated certificate of incorporation or the amended and restated bylaws in a manner that modifies the voting, conversion or other powers, preferences, or other special rights or privileges, or restrictions of the Class B common stock; |

| · | if we reclassify any outstanding shares of Class A common stock into shares having rights as to dividends or liquidation that are senior to the Class B common stock or, in the case of Class A common stock, the right to more than one vote for each share thereof; or |

| · | if we authorize any shares of preferred stock with rights as to dividends or liquidation that are senior to the Class B common stock or the right to more than one vote for each share thereof. |

Dividend Rights

The shares of Class B common stock have no economic rights. Holders of shares of our Class B common stock do not have any rights to receive dividends.

Liquidation Rights

On our liquidation, dissolution or winding up, holders of Class B common stock will not be entitled to receive any distribution of our assets.

Transfers

Pursuant to the DDH LLC Agreement, each holder of Class B common stock agrees that:

| · | the holder will not transfer any shares of Class B common stock to any person unless the holder transfers an equal number of LLC Units to the same person; and |

| · | in the event the holder transfers any LLC Units to any person, the holder will transfer an equal number of shares of Class B common stock to the same person. |

12

Other Matters

No shares of Class B common stock will have preemptive rights to purchase additional shares of Class B common stock. Holders of shares of our Class B common stock do not have subscription, redemption or conversion rights. There will be no redemption or sinking fund provisions applicable to the Class B common stock. Upon consummation of this offering, all outstanding shares of Class B common stock will be validly issued, fully paid and nonassessable.

Preferred Stock

Our board of directors has the authority, subject to limitations prescribed by Delaware law, to issue up to 10,000,000 shares of “blank check” preferred stock in one or more series, to establish from time to time the number of shares to be included in each series and to fix the designation, powers, preferences and rights of the shares of each series and any of its qualifications, limitations or restrictions, in each case without further vote or action by our stockholders. Our board of directors can also increase or decrease the number of shares of any series of preferred stock, but not below the number of shares of that series then outstanding, without any further vote or action by our stockholders. Our board of directors may authorize the issuance of preferred stock with voting or conversion rights that could adversely affect the voting power or other rights of the holders of our Class A common stock. The issuance of preferred stock, while providing flexibility in connection with possible acquisitions and other corporate purposes, could, among other things, have the effect of delaying, deferring or preventing a change in control of Direct Digital Holdings and might adversely affect the market price of our Class A common stock and the voting and other rights of the holders of our Class A common stock.

Anti-Takeover Provisions

Our certificate of incorporation and bylaws contain provisions that could delay or prevent a change in control of Direct Digital. These provisions could also make it difficult for stockholders to elect directors that are not nominated by the current members of our board of directors or take other corporate actions, including effecting changes in our management. These provisions include certain provisions that:

| · | permit the board of directors to establish the number of directors and fill any vacancies and newly created directorships; |

| · | provide that, after a removal for cause, vacancies on our board of directors may be filled only by a majority of directors then in office, even though less than a quorum; |

| · | prohibit cumulative voting in the election of directors; |

| · | require the affirmative vote of the holders of 66 2/3% of the voting power of our outstanding common stock to amend certain provisions of our certificate of incorporation and bylaws; |

| · | authorize the issuance of “blank check” preferred stock that our board of directors could use to implement a stockholder rights plan; |

| · | restrict the forum for certain litigation against us to Delaware or federal courts; |

| · | permit our board of directors to alter our bylaws without obtaining stockholder approval; and |

| · | establish advance notice requirements for nominations for election to our board of directors or for proposing matters that can be acted upon by stockholders at annual stockholder meetings. |

In addition, as a Delaware corporation, we are subject to Section 203 of the Delaware General Corporation Law (the “DGCL”). These provisions may prohibit large stockholders, in particular those owning 15% or more of our outstanding voting stock, from merging or combining with us for a period of time without the approval of our board of directors. In addition, our credit facility includes, and other debt instruments we may enter into in the future may include, provisions entitling the lenders to demand immediate repayment of all borrowings upon the occurrence of certain change of control events relating to us, which also could discourage, delay or prevent a business combination transaction.

13

Transfer Agent and Registrar

The transfer agent and registrar for our capital stock is American Stock Transfer & Trust Company, LLC.

Stock Market Listing

Our Class A common stock is listed on The Nasdaq Capital Market under the symbol “DRCT.”

14

DESCRIPTION OF DEBT SECURITIES

The following description, together with the additional information we include in any applicable prospectus supplements, summarizes the material terms and provisions of the debt securities that we may offer under this prospectus. While the terms we have summarized below will apply generally to any future debt securities we may offer pursuant to this prospectus, we will describe the particular terms of any debt securities that we may offer in more detail in the applicable prospectus supplement. If we so indicate in a prospectus supplement, the terms of any debt securities offered under such prospectus supplement may differ from the terms we describe below, and to the extent the terms set forth in a prospectus supplement differ from the terms described below, the terms set forth in the prospectus supplement shall control.

We may sell from time to time, in one or more offerings under this prospectus, debt securities, which may be senior or subordinated. We will issue any such senior debt securities under a senior indenture that we will enter into with a trustee to be named in the senior indenture. We will issue any such subordinated debt securities under a subordinated indenture, which we will enter into with a trustee to be named in the subordinated indenture. We use the term “indentures” to refer to either the senior indenture or the subordinated indenture, as applicable. The indentures will be qualified under the Trust Indenture Act of 1939, as in effect on the date of the indenture (the “Trust Indenture Act”). We use the term “debenture trustee” to refer to either the trustee under the senior indenture or the trustee under the subordinated indenture, as applicable.

The following summaries of material provisions of the senior debt securities, the subordinated debt securities and the indentures are subject to, and qualified in their entirety by reference to, all the provisions of the indenture applicable to a particular series of debt securities.

General

Each indenture will provide that debt securities may be issued from time to time in one or more series and may be denominated and payable in U.S. dollars or foreign currencies or units based on or relating to U.S. dollars or foreign currencies. Neither indenture will limit the amount of debt securities that may be issued thereunder, provided the aggregate principal amount will not exceed the amount registered hereunder and remaining available for issuance. Each indenture will provide that the specific terms of any series of debt securities shall be set forth in, or determined pursuant to, an authorizing resolution and/or a supplemental indenture, if any, relating to such series.

We will describe in each prospectus supplement the following terms relating to a series of debt securities:

| · | the title or designation; |

| · | the aggregate principal amount and any limit on the amount that may be issued; |

| · | the currency or units based on or relating to currencies in which debt securities of such series are denominated and the currency or units in which principal or interest or both will or may be payable; |

| · | whether we will issue the series of debt securities in global form, the terms of any global securities and who the depositary will be; |

| · | the maturity date and the date or dates on which principal will be payable; |

| · | the interest rate, which may be fixed or variable, or the method for determining the rate and the date interest will begin to accrue, the date or dates interest will be payable and the record dates for interest payment dates or the method for determining such dates; |

| · | whether or not the debt securities will be secured or unsecured, and the terms of any secured debt; |

| · | the terms of the subordination of any series of subordinated debt; |

15

| · | the place or places where payments will be payable; |

| · | our right, if any, to defer payment of interest and the maximum length of any such deferral period; |

| · | the date, if any, after which, and the price at which, we may, at our option, redeem the series of debt securities pursuant to any optional redemption provisions; |

| · | the date, if any, on which, and the price at which we are obligated, pursuant to any mandatory sinking fund provisions or otherwise, to redeem, or at the holder’s option to purchase, the series of debt securities; |

| · | whether the indenture will restrict our ability to pay dividends, or will require us to maintain any asset ratios or reserves; |

| · | whether we will be restricted from incurring any additional indebtedness; |

| · | a discussion on any material U.S. federal income tax considerations applicable to a series of debt securities; |

| · | the denominations in which we will issue the series of debt securities, if other than denominations of $1,000 and any integral multiple thereof; and |

| · | any other specific terms, preferences, rights or limitations of, or restrictions on, the debt securities. |

We may issue debt securities that provide for an amount less than their stated principal amount to be due and payable upon declaration of acceleration of their maturity pursuant to the terms of the indenture.

Conversion or Exchange Rights

We will set forth in the prospectus supplement the terms, if any, on which a series of debt securities may be convertible into or exchangeable for our Class A common stock or our other securities. Even if non-convertible, there may be instances in which a noteholder may seek the right to exchange such debt for equity. We will include provisions as to whether conversion or exchange is mandatory, at the option of the holder or at our option. We may include provisions pursuant to which the number of shares of our Class A common stock or our other securities that the holders of the series of debt securities receive would be subject to adjustment.

Information Concerning the Debenture Trustee

The debenture trustee, other than during the occurrence and continuance of an event of default under the applicable indenture, will undertake to perform only those duties as are specifically set forth in the applicable indenture. Upon an event of default under an indenture, the debenture trustee under such indenture must use the same degree of care as a prudent person would exercise or use in the conduct of his or her own affairs. Subject to this provision, the debenture trustee is under no obligation to exercise any of the powers given it by the indenture at the request of any holder of debt securities unless it is offered reasonable security and indemnity against the costs, expenses and liabilities that it might incur.

Payment and Paying Agents

Unless we otherwise indicate in the applicable prospectus supplement, we will make payment of the interest on any debt securities on any interest payment date to the person in whose name the debt securities, or one or more predecessor securities, are registered at the close of business on the regular record date for the interest.

We will pay principal of and any premium and interest on the debt securities of a particular series at the office of the paying agents designated by us, except that unless we otherwise indicate in the applicable prospectus supplement, we will make interest payments by check which we will mail to the holder. Unless we otherwise indicate in a prospectus supplement, we will designate the corporate trust office of the debenture trustee in the City of New York as our sole paying agent for payments with respect to debt securities of each series. We will name in the applicable prospectus supplement any other paying agents that we initially designate for the debt securities of a particular series. We will maintain a paying agent in each place of payment for the debt securities of a particular series.

16

All money we pay to a paying agent or the debenture trustee for the payment of the principal of or any premium or interest on any debt securities that remains unclaimed at the end of two years after such principal, premium or interest has become due and payable will be repaid to us, and the holder of the security thereafter may look only to us for payment thereof.

Governing Law

The indentures and the debt securities will be governed by and construed in accordance with the laws of the State of New York, except to the extent that the Trust Indenture Act is applicable.

Subordination of Subordinated Debt Securities

Our obligations pursuant to any subordinated debt securities will be unsecured and will be subordinate and junior in priority of payment to certain of our other indebtedness to the extent described in a prospectus supplement. The subordinated indenture will not limit the amount of senior indebtedness we may incur. It also will not limit us from issuing any other secured or unsecured debt.

17

General

We may issue warrants to purchase shares of our common stock, preferred stock and/or debt securities. We may offer warrants separately or together with one or more additional warrants, debt securities, shares of common stock, or shares of preferred stock, or any combination of those securities in the form of units, as described in the applicable prospectus supplement. Each series of warrants will be issued under a separate warrant agreement to be entered into between us and a bank or trust company, as warrant agent. The warrant agent will act solely as our agent in connection with the certificates relating to the series of warrants and will not assume any obligation or relationship of agency or trust for or with any holders of warrants certificates or beneficial owners of warrants. The following description sets forth certain general terms and provisions of the warrants to which any prospectus supplement may relate. The particular terms of the warrant to which any prospectus supplement may relate and the extent, if any, to which the general provisions may apply to the warrants so offered will be described in the applicable prospectus supplement. To the extent that any particular terms of the warrant, warrant agreement or warrant certificates described in a prospectus supplement differ from any of the terms described below, then the terms described below will be deemed to have been superseded by that prospectus supplement. We encourage you to read the applicable warrant agreement and warrant certificate for additional information before you decide whether to purchase any of our warrants.

We will provide in a prospectus supplement the following terms of the warrants being issued:

| · | the specific designation and aggregate number of, and the price at which we will issue, the warrants; |

| · | the currency or currency units in which the offering price, if any, and the exercise price are payable; |

| · | the designation, amount and terms of the securities purchasable upon exercise of the warrants; |

| · | if applicable, the exercise price for shares of our Class A common stock and the number of shares of common stock to be received upon exercise of the warrants; |

| · | if applicable, the exercise price for shares of our preferred stock, the number of shares of preferred stock to be received upon exercise, and a description of that series of our preferred stock; |

| · | if applicable, the exercise price for our debt securities, the amount of debt securities to be received upon exercise, and a description of that series of debt securities; |

| · | the date on which the right to exercise the warrants will begin and the date on which that right will expire or, if the holder may not continuously exercise the warrants throughout that period, the specific date or dates on which the holder may exercise the warrants; |

| · | whether the warrants will be issued in fully registered form or bearer form, in definitive or global form or in any combination of these forms, although, in any case, the form of a warrant included in a unit (if applicable) will correspond to the form of the unit and of any security included in that unit; |

| · | any applicable material U.S. federal income tax consequences; |

| · | the identity of the warrant agent for the warrants and of any other depositaries, execution or paying agents, transfer agents, registrars or other agents; |

| · | the proposed listing, if any, of the warrants or any securities purchasable upon exercise of the warrants on any securities exchange; |

| · | if applicable, the date from and after which the warrants and the common stock, preferred stock and/or debt securities (to the extent included together in a unit) will be separately transferable; |

18

| · | if applicable, the minimum or maximum amount of the warrants that may be exercised at any one time; |

| · | information with respect to book-entry procedures, if any; |

| · | the anti-dilution provisions of the warrants, if any; |

| · | any redemption or call provisions; |

| · | whether the warrants may be sold separately or with other securities as parts of units (if applicable); and |

| · | any additional terms of the warrants, including terms, procedures and limitations relating to the exchange and exercise of the warrants. |

Warrant Agent

The warrant agent for any warrants we offer will be set forth in the applicable prospectus supplement.

19

The following description, together with the additional information that we include in any applicable prospectus supplements, summarizes the material terms and provisions of the units that we may offer under this prospectus. While the terms we have summarized below will apply generally to any units that we may offer under this prospectus, we will describe the particular terms of any series of units in more detail in the applicable prospectus supplement. The terms of any units offered under a prospectus supplement may differ from the terms described below.

We will incorporate by reference from reports that we file with the SEC the form of unit agreement that describes the terms of the series of units we are offering, and any supplemental agreements, before the issuance of the related series of units. The following summary of material terms and provisions of the units are subject to, and qualified in their entirety by reference to, all the provisions of the unit agreement and any supplemental agreements applicable to a particular series of units. We urge you to read the applicable prospectus supplements related to the particular series of units that we may offer under this prospectus, and the complete unit agreement and any supplemental agreements that contain the terms of the units. To the extent that any particular terms of the units or unit agreement described in a prospectus supplement differ from any of the terms described below, then the terms described below will be deemed to have been superseded by that prospectus supplement.

General

We may issue units consisting of common stock, preferred stock, one or more debt securities and/or warrants for the purchase of common stock, preferred stock and/or debt securities in one or more series, in any combination. Each unit will be issued so that the holder of the unit is also the holder of each security included in the unit. Thus, the holder of a unit will have the rights and obligations of a holder of each security included in the unit. The unit agreement under which a unit is issued may provide that the securities included in the unit may not be held or transferred separately, at any time or at any time before a specified date.

We will describe in the applicable prospectus supplement the terms of the series of units being offered, including:

| · | the designation and terms of the units and of the securities comprising the units, including whether and under what circumstances those securities may be held or transferred separately; |

| · | any provisions of the governing unit agreement; |

| · | the price or prices at which such units will be issued; |

| · | the material U.S. federal income tax considerations relating to the units; and |

| · | any provisions for the issuance, payment, settlement, transfer or exchange of the units or of the securities comprising the units. |

The provisions described in this section, as well as those set forth in any prospectus supplement or as described under “Description of Capital Stock” “Description of Debt Securities,” and “Description of Warrants” will apply to each unit, as applicable, and to any common stock, preferred stock, debt security or warrant included in each unit, as applicable.

Unit Agent

The name and address of the unit agent for any units we offer will be set forth in the applicable prospectus supplement.

Issuance in Series

We may issue units in such amounts and in such numerous distinct series as we determine.

20

Enforceability of Rights by Holders of Units

Each unit agent will act solely as our agent under the applicable unit agreement and will not assume any obligation or relationship of agency or trust with any holder of any unit. A single bank or trust company may act as unit agent for more than one series of units. A unit agent will have no duty or responsibility in case of any default by us under the applicable unit agreement or unit, including any duty or responsibility to initiate any proceedings at law or otherwise, or to make any demand upon us. Any holder of a unit may, without the consent of the related unit agent or the holder of any other unit, enforce by appropriate legal action its rights as holder under any security included in the unit.

21

General Plan of Distribution

We may offer securities under this prospectus from time to time pursuant to underwritten public offerings, negotiated transactions, block trades or a combination of these methods. We may sell the securities (1) through underwriters or dealers, (2) through agents or (3) directly to one or more purchasers, or through a combination of such methods. We may distribute the securities from time to time in one or more transactions at:

| · | a fixed price or prices, which may be changed from time to time; |

| · | market prices prevailing at the time of sale; |

| · | prices related to the prevailing market prices; or |

| · | negotiated prices. |

We may directly solicit offers to purchase the securities being offered by this prospectus. We may also designate agents to solicit offers to purchase the securities from time to time. We will name in a prospectus supplement any underwriter or agent involved in the offer or sale of the securities.

If we utilize a dealer in the sale of the securities being offered by this prospectus, we will sell the securities to the dealer, as principal. The dealer may then resell the securities to the public at varying prices to be determined by the dealer at the time of resale.

If we utilize an underwriter in the sale of the securities being offered by this prospectus, we will execute an underwriting agreement with the underwriter at the time of sale, and we will provide the name of any underwriter in the prospectus supplement which the underwriter will use to make re-sales of the securities to the public. In connection with the sale of the securities, we, or the purchasers of the securities for whom the underwriter may act as agent, may compensate the underwriter in the form of underwriting discounts or commissions. The underwriter may sell the securities to or through dealers, and the underwriter may compensate those dealers in the form of discounts, concessions or commissions.

With respect to underwritten public offerings, negotiated transactions and block trades, we will provide in the applicable prospectus supplement information regarding any compensation we pay to underwriters, dealers or agents in connection with the offering of the securities, and any discounts, concessions or commissions allowed by underwriters to participating dealers. Underwriters, dealers and agents participating in the distribution of the securities may be deemed to be underwriters within the meaning of the Securities Act, and any discounts and commissions received by them and any profit realized by them on resale of the securities may be deemed to be underwriting discounts and commissions. We may enter into agreements to indemnify underwriters, dealers and agents against civil liabilities, including liabilities under the Securities Act, or to contribute to payments they may be required to make in respect thereof.

We may authorize agents or underwriters to solicit offers by certain types of institutional investors to purchase securities from us at the public offering price set forth in the applicable prospectus supplement pursuant to delayed delivery contracts providing for payment and delivery on a specified date in the future. We will describe the conditions to these contracts and the commissions we must pay for solicitation of these contracts in the prospectus supplement.

Shares of our Class A common stock sold pursuant to the registration statement of which this prospectus is a part will be authorized for listing and trading on the Nasdaq Capital Market. The applicable prospectus supplement will contain information, where applicable, as to any other listing, if any, on the Nasdaq Capital Market or any securities market or other securities exchange of the securities covered by the prospectus supplement. We can make no assurance as to the liquidity of or the existence of trading markets for any of the securities.

22

In order to facilitate the offering of the securities, certain persons participating in the offering may engage in transactions that stabilize, maintain or otherwise affect the price of the securities. This may include over-allotments or short sales of the securities, which involve the sale by persons participating in the offering of more securities than we sold to them. In these circumstances, these persons would cover such over-allotments or short positions by making purchases in the open market or by exercising their over-allotment option. In addition, these persons may stabilize or maintain the price of the securities by bidding for or purchasing the applicable security in the open market or by imposing penalty bids, whereby selling concessions allowed to dealers participating in the offering may be reclaimed if the securities sold by them are repurchased in connection with stabilization transactions. The effect of these transactions may be to stabilize or maintain the market price of the securities at a level above that which might otherwise prevail in the open market. These transactions may be discontinued at any time.

In compliance with the guidelines of the Financial Industry Regulatory Authority, Inc., or FINRA, the maximum consideration or discount to be received by any FINRA member or independent broker dealer may not exceed 8% of the aggregate amount of the securities offered pursuant to this prospectus and any applicable prospectus supplement.

The underwriters, dealers and agents may engage in other transactions with us, or perform other services for us, in the ordinary course of their business.

23

The validity of the securities and certain other matters will be passed upon for us by McGuireWoods LLP, Charlotte, North Carolina. Additional legal matters may be passed upon for us or any underwriters, dealers or agents, by counsel that we name in the applicable prospectus supplement.

The financial statements of Direct Digital Holdings, Inc. as of December 31, 2022 and 2021, the related consolidated statements of operations, changes in stockholders’ / members’ equity (deficit) and cash flows for each of the two years in the period ended December 31, 2022 and the related notes incorporated by reference herein have been audited by Marcum LLP, our independent registered public accounting firm, as set forth in its report thereon incorporated by reference herein, and are incorporated by reference herein in reliance upon such report given on the authority of such firm as experts in accounting and auditing.

WHERE YOU CAN FIND MORE INFORMATION

We are a reporting company and file annual, quarterly and current reports, proxy statements and other information with the SEC. We have filed with the SEC a registration statement on Form S-3 under the Securities Act with respect to the securities we are offering under this prospectus. This prospectus does not contain all of the information set forth in the registration statement and the exhibits to the registration statement. For further information with respect to us and the securities offered under this prospectus, we refer you to the registration statement and the exhibits filed as a part of the registration statement. The SEC maintains an Internet site that contains reports, proxy and information statements and other information regarding issuers that file electronically with the SEC, including Direct Digital Holdings. The SEC’s Internet site can be found at www.sec.gov. We maintain a website at www.directdigitalholdings.com. Information found on, or accessible through, our website is not a part of, and is not incorporated into, this prospectus, and you should not consider it part of this prospectus.

INCORPORATION OF INFORMATION BY REFERENCE

The SEC allows us to “incorporate by reference” information that we file with it. Incorporation by reference allows us to disclose important information to you by referring you to those other documents. The information incorporated by reference is an important part of this prospectus, and information that we file later with the SEC will automatically update and supersede this information. This prospectus omits certain information contained in the registration statement, as permitted by the SEC. You should refer to the registration statement and any prospectus supplement filed hereafter, including the exhibits, for further information about us and the securities we may offer pursuant to this prospectus. Statements in this prospectus regarding the provisions of certain documents filed with, or incorporated by reference in, the registration statement are not necessarily complete and each statement is qualified in all respects by that reference. Copies of all or any part of the registration statement, including the documents incorporated by reference or the exhibits, may be obtained upon payment of the prescribed rates at the offices of the SEC listed above in “Where You Can Find More Information.” The documents we are incorporating by reference are:

| · | our Annual Report on Form 10-K for the fiscal year ended December 31, 2022, filed with the SEC on April 17, 2023; |

| · | our Current Reports on Form 8-K filed on January 11, 2023, January 18, 2023 and March 13, 2023 |

24

| · | the description of the Registrant’s Securities Registered Pursuant to Section 12 of the Exchange Act, incorporated by reference to our Registration Statement on Form 8-A filed February 3, 2022. |

In addition, all documents that we file pursuant to Sections 13(a), 13(c), 14 and 15(d) of the Exchange Act, subsequent to the filing of this Registration Statement and prior to the filing of a post-effective amendment which indicates that all securities offered hereby have been sold or which deregisters all securities then remaining unsold, shall be deemed to be incorporated by reference into this Registration Statement and to be a part hereof from the date of filing of such documents, except as to any document or portion of any document that is deemed furnished and not filed.

Pursuant to Rule 412 under the Securities Act, any statement contained in the documents incorporated or deemed to be incorporated by reference in this Registration Statement shall be deemed to be modified, superseded or replaced for purposes of this Registration Statement to the extent that a statement contained herein or in any other subsequently filed document which also is incorporated or deemed to be incorporated by reference in this Registration Statement modifies, supersedes or replaces such statement. Any such statement so modified, superseded or replaced shall not be deemed, except as so modified, superseded or replaced, to constitute a part of this Registration Statement.