PART I

ITEM 1.Business

Company Overview

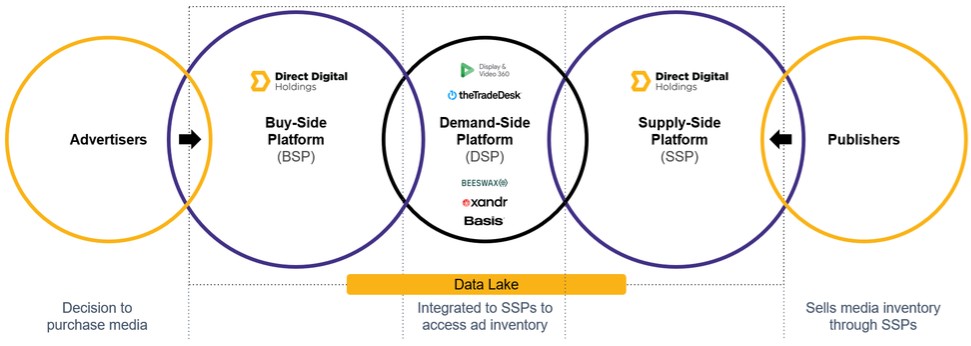

We are an end-to-end, full-service advertising and marketing platform primarily focused on providing advertising technology, data-driven campaign optimization and other solutions to help brands, agencies, middle market businesses deliver successful marketing results that drive return on investment ("ROI") across both the sell- and buy-side of the digital advertising ecosystem. Direct Digital Holdings, Inc., incorporated as a Delaware corporation on August 23, 2021, is the holding company for DDH LLC, the business formed by our founders in 2018 through the acquisitions of Colossus Media and Huddled Masses. Colossus Media operates our proprietary sell-side programmatic platform (“SSP”) operating under the trademarked banner of Colossus SSP™, which provides advertisers of all sizes a programmatic advertising platform that automates the sale of ad inventory between advertisers and agencies leveraging proprietary technology. Our platform offers extensive reach within both general market and multicultural media partners to help Fortune 500 brands and agencies scale to reach highly sought after audiences and helps publishers find the right brands for their readers, as well as drive advertising yields across all channels: web, mobile, and connected TV ("CTV").

Both buy-side advertising businesses, Orange 142 and Huddled Masses, provide technology-enabled advertising solutions and consulting services to clients through multiple leading demand side platforms (“DSPs”), across multiple industry verticals such as travel, education, healthcare, financial services, consumer products and other sectors with particular emphasis on small and mid-sized businesses transitioning into digital with growing digital media budgets. In February 2022, we completed our initial public offering and certain organizational transactions which resulted in our current structure.

In the digital advertising space, buyers, particularly small and mid-sized businesses, can potentially achieve significantly higher ROI on their advertising spend compared to traditional media advertising by leveraging data-driven over-the-top/connected TV (“OTT/CTV”), video and display, in-app, native and audio advertisements that are delivered both at scale and on a highly targeted basis.

Programmatic Marketplace Transaction

The Sell-Side

On the sell-side of the digital supply chain, the supply side platform (“SSP”), is an ad technology platform used by publishers to sell, manage and optimize the ad inventory on their websites in an automated and effective way. The SSPs help the publishers monetize the display ads, video ads, and native ads on their websites and mobile apps. The SSPs have enhanced their functionalities over the years and have included ad exchange mechanisms to efficiently manage their ad

5